Foundations of Economics, 6/E Robin Bade Michael Parkin solutions manual and test bank

Foundations of Microeconomics, 6e (Bade/Parkin)

Chapter 20 Economic Inequality

20.1 Measuring Economic Inequality

1) In the United States, the poorest 20 percent of the household receive approximately ________ percent of total money income.

A) 3.3

B) 9.5

C) 11.8

D) 17.6

E) 20.0

Answer: A

Topic: Inequality in the United States, income

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: Revised

AACSB: Reflective thinking

2) In the United States, the richest 20 percent of households receive approximately ________ percent of total money income.

A) 33

B) 12

C) 50

D) 75

E) 20

Answer: C

Topic: Inequality in the United States, income

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: JC

AACSB: Reflective thinking

3) In the United States, the poorest 20 percent of households receive about ________ percent of total money income while the richest 20 percent receive about ________ percent of total money income.

A) 3; 50

B) 8; 71

C) 12.; 32

D) 13; 68

E) 20; 20

Answer: A

Topic: Inequality in the United States, income

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: Revised

AACSB: Reflective thinking

4) Which of the following statements is true regarding the distribution of income in the United States?

A) The Lorenz curve shows that incomes are distributed fairly.

B) The line of equality shows that incomes are distributed equally.

C) The inequality in the distribution of income can be seen because the Lorenz curve lies below the line of equality.

D) The inequality in the distribution of income can be seen because the Lorenz curve lies above the line of equality.

E) Both answers A and B are correct.

Answer: C

Topic: Inequality in the United States, income

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: Revised

AACSB: Reflective thinking

5) In 2004 the wealthiest 1 percent of all U.S. households owned what percentage of total wealth?

A) more than 30 percent

B) less than 10 percent

C) more than 40 percent

D) more than 50 percent

E) more than 45 percent

Answer: A

Topic: Inequality in the United States, wealth

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: New

AACSB: Reflective thinking

6) As a tool that is used to measure inequality in the distribution of income, the Lorenz curve graphs

A) the cumulative percentage of money income against the cumulative percentage of households.

B) the percentage of total money income received by each given percentage of households.

C) the mean income, median income, and mode income against the percentage of households.

D) the mean money income received by households over time.

E) the cumulative percentage of money income against the mean and median money income.

Answer: A

Topic: Lorenz curve

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: MR

AACSB: Reflective thinking

7) A Lorenz curve for income shows the

A) demand for Lorenz cough drops.

B) average income graphed against the average number of people in the household.

C) cumulative percentage of income graphed against cumulative percentage of households.

D) relationship between income and wealth.

E) total amount of income graphed against the total number of households.

Answer: C

Topic: Lorenz curve

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: TS

AACSB: Reflective thinking

8) Lorenz curves are

A) horizontal.

B) vertical.

C) upward sloping.

D) downward sloping.

E) straight lines.

Answer: C

Topic: Lorenz curve

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: SB

AACSB: Reflective thinking

9) A Lorenz curve

A) is identical to the straight line sloping up at a 45° angle.

B) lies above the straight line sloping up at a 45° angle.

C) lies below the straight line sloping up at a 45° angle.

D) starts below the straight line sloping up at a 45° angle and then ends above this line.

E) starts above the straight line sloping up at a 45° angle and then ends below this line.

Answer: C

Topic: Lorenz curve

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: TS

AACSB: Reflective thinking

10) If the Lorenz curve for income moves upward toward the 45° line, then the

A) distribution of income has become more unequal.

B) distribution of income has become more equal.

C) mean (average) household income increased.

D) total household income increased.

E) total household income decreased.

Answer: B

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: TS

AACSB: Reflective thinking

11) If all households in a nation receive the same income, the nation's Lorenz curve

A) is horizontal.

B) is vertical.

C) is a 45° line.

D) runs along the horizontal axis until it reaches 50 percent of households and then runs vertically up to 100 percent of income.

E) runs along the horizontal axis until it reaches 100 percent of households and then runs vertically up to 100 percent of income.

Answer: C

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

12) Country A has a more equal distribution of income than country B if

A) country A's Lorenz curve is closer to the line of equality than is country B's Lorenz curve.

B) country B's Lorenz curve is closer to the line of equality than is country A's Lorenz curve.

C) country A's Lorenz curve is just as close to the line of equality as is country B's Lorenz curve.

D) country A's Lorenz curve lies below country B's Lorenz curve at low levels of income and above it at high levels of income.

E) None of the above because it is impossible to compare income inequalities across countries.

Answer: A

Topic: Lorenz curve

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: MR

AACSB: Reflective thinking

13) Looking at the Lorenz curves for income distribution in all the world's nations, we would find that

A) some nations have Lorenz curves that lie above the 45° line, other nations have Lorenz curves that lie below the 45° line, but no nation has a Lorenz curve that lie on the 45° line.

B) all nations have Lorenz curves that lie above the 45° line.

C) all nations have Lorenz curves that lie below the 45° line.

D) some nations have Lorenz curves that lie above the 45° line, other nations have Lorenz curves that lie below the 45° line, and still other nations have a Lorenz curve that lies on the 45° line.

E) None of the above answers is correct.

Answer: C

Topic: Lorenz curve

Skill: Level 5: Critical thinking

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

| Group | Percent of income |

| Poorest 20% | 5 |

| Second poorest 20% | 10 |

| Middle 20% | 15 |

| Second richest 20% | 25 |

| Richest 20% | 45 |

The table gives the distribution of income in Miseria.

14) What percent of income is earned by the richest forty percent?

A) 5 percent

B) 20 percent

C) 70 percent

D) 55 percent

E) More information is needed to answer the question.

Answer: C

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

15) What percent of income is earned by the richest 60 percent of the population?

A) 25 percent

B) 30 percent

C) 55 percent

D) 85 percent

E) More information is needed to answer the question.

Answer: D

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

16) What percent of income is earned by the poorest 60 percent of the population?

A) 25 percent

B) 30 percent

C) 55 percent

D) 15 percent

E) More information is needed to answer the question.

Answer: D

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

17) What percent of income is earned by the richest 80 percent of the population?

A) 25 percent

B) 95 percent

C) 100 percent

D) 5 percent

E) More information is needed to answer the question.

Answer: B

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

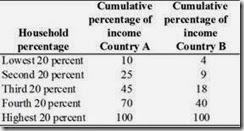

18) The above table shows the distribution of income in two countries, Alpha and Beta. Based on these distributions of income,

A) Country Beta has more equal income distribution than does Country Alpha.

B) both countries have equal distributions because 100 percent of the incomes are accounted for.

C) the Lorenz Curve for country Beta is closer to the line of equality.

D) Country Alpha has a more equal distribution of income than does Country Beta.

E) It is impossible to answer the question without more information.

Answer: D

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: CD

AACSB: Analytical reasoning

19) The above table shows the distribution of income in two countries, Alpha and Beta. In Country Alpha, the poorest 20 percent receive ________ percent of total income.

A) 5

B) 9

C) 1

D) 19

E) 14

Answer: B

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: CD

AACSB: Analytical reasoning

20) The above table shows the distribution of income in two countries, Alpha and Beta. In Country Beta, the richest 40 percent of households receive ________ percent of total income.

A) 20

B) 40

C) 60

D) 80

E) 100

Answer: D

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: CD

AACSB: Analytical reasoning

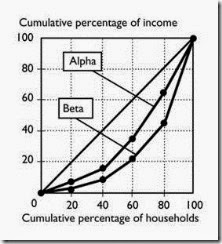

21) In the figure above, the nation with the most equal distribution of income is nation

A) A.

B) B.

C) C.

D) The distribution of income is the same in all three nations because their Lorenz curves can be plotted on the same diagram.

E) It is impossible to determine with the information given.

Answer: C

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: PH

AACSB: Analytical reasoning

22) In the figure above, the nation with the least equal distribution of income is nation

A) A.

B) B.

C) C.

D) The distribution of income is the same in all three nations because their Lorenz curves can be plotted on the same diagram.

E) It is impossible to determine with the information given.

Answer: A

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

23) In the figure above, the nation with the highest average income is nation

A) A.

B) B.

C) C.

D) The average income is the same in all three nations because their Lorenz curves can be plotted on the same diagram.

E) It is impossible to determine with the information given.

Answer: E

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

24) In the United States, it is the case that

A) both income and wealth are equally distributed.

B) wealth is equally distributed but income is distributed unequally.

C) income is equally distributed but wealth is distributed unequally.

D) both income and wealth are unequally distributed and wealth is distributed more unequally than is income.

E) both income and wealth are unequally distributed and income is distributed more unequally than is wealth.

Answer: D

Topic: Wealth and income distribution

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: TS

AACSB: Reflective thinking

25) Comparing the wealth and income distribution in the United States, we see that

A) wealth is distributed less equally than income.

B) because wealth and income are different terms for the same thing, the distributions are the same.

C) income is distributed less equally than wealth.

D) we cannot compare the distribution of wealth and income.

E) None of the above answers is correct.

Answer: A

Topic: Wealth and income distribution

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

26) In the United States, the

A) distribution of income has become more equal since 1970.

B) Lorenz curve for income and the Lorenz curve for wealth are equally close to the line of equality.

C) Lorenz curve for income is closer to the line of equality than is the Lorenz curve for wealth.

D) Lorenz curve for wealth is closer to the line of equality than is the Lorenz curve for income.

E) None of the above answers is correct.

Answer: C

Topic: Wealth and income distribution

Skill: Level 4: Applying models

Section: Checkpoint 20.1

Status: CD

AACSB: Reflective thinking

27) Which of the following statements is correct?

A) Wealth inequality in the United States is greater than income inequality.

B) Income inequality in the United States is greater than wealth inequality.

C) Income includes all the things owned by a household at a certain point in time.

D) The top fifth of households have a greater share of the nation's income than the nation's wealth.

E) The fraction of wealth owned by the bottom 20 percent of households is larger than the fraction income earned by the bottom 20 percent of households.

Answer: A

Topic: Wealth and income distribution

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: SA

AACSB: Reflective thinking

28) Looking at the income distribution in the United States since 1970, we see that

A) only the lowest 20 percent and highest 20 percent increased their shares of income.

B) the lower 50 percent increased its share of income and the upper 50 percent stayed the same.

C) the highest 20 percent increased its share of income.

D) all the 20 percent groups increased their shares of income.

E) the lower 50 percent increased its share of income and the upper 50 percent decreased its share of income.

Answer: C

Topic: Economic mobility

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

29) In the United States, since 1970 the share of income received by the richest 20 percent of households has ________ and the share received by the other 80 percent of households has ________.

A) increased; increased

B) increased; decreased

C) decreased; increased

D) not changed; not changed

E) increased; not changed

Answer: B

Topic: Economic mobility

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: PH

AACSB: Reflective thinking

30) In the United States since 1970 income has become ________ equally distributed and since the 1970s economic mobility among income groups has ________.

A) more; increased

B) more; decreased

C) less; increased

D) less; decreased

E) None of the above answers is correct because economic mobility among income groups cannot be measured.

Answer: D

Topic: Economic mobility

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: TS

AACSB: Reflective thinking

31) Since 1970 in the United States, the distribution of income has changed and the group that benefited the most has been the

A) better educated.

B) less educated.

C) low-skilled workers.

D) middle class, that is the group in the middle 20 percent of the income distribution.

E) None of the above answers is correct because all groups benefited equally.

Answer: A

Topic: Economic mobility

Skill: Level 5: Critical thinking

Section: Checkpoint 20.1

Status: TS

AACSB: Reflective thinking

32) The factor that leads to the largest difference in households' incomes is

A) race.

B) education.

C) gender.

D) size of household.

E) location of household.

Answer: B

Topic: Income distribution by characteristic

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: SA

AACSB: Reflective thinking

33) ________ is the single biggest factor affecting income distribution in the United States.

A) Location of household

B) Type of household

C) Education

D) Age of household

E) Gender

Answer: C

Topic: Income distribution by characteristic

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: MR

AACSB: Reflective thinking

34) Of the following major characteristics that lead to income disparity, the factor with the smallest impact is

A) sex.

B) race.

C) region of the country.

D) education.

E) number of people in the household.

Answer: C

Topic: Income distribution by characteristic

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

35) The highest-income household in the United States today is likely to be a college-educated

A) married white couple.

B) single white female.

C) married Asian couple.

D) single black male.

E) single black female.

Answer: A

Topic: Income distribution by characteristic

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: JC

AACSB: Reflective thinking

36) Measured annual income inequality overstates actual lifetime inequality because

A) poverty levels vary across states.

B) homeless people are not always counted.

C) different households are in different stages in the life cycle.

D) people tend to overstate their incomes.

E) people differ in the amount of education they have attained.

Answer: C

Topic: Annual versus lifetime income

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: SB

AACSB: Reflective thinking

37) The measured inequality of annual income ________ the actual inequality of lifetime income because ________.

A) overstates; different households are at different stages in the life cycle

B) overstates; the Lorenz curves differ for income and wealth

C) understates; people live in different geographic areas

D) understates; people have different levels of education

E) overstates; different households have different amounts of wealth

Answer: A

Topic: Annual versus lifetime income

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: CD

AACSB: Reflective thinking

38) Poverty for a household is defined as the state of

A) having a total income that is below the median total income.

B) having an income that can be spent on food, shelter, and clothing that is below the median for food, shelter, and clothing.

C) income below what is thought fair.

D) income below what is thought necessary for food, shelter, and clothing.

E) having an income that is below average.

Answer: D

Topic: Poverty

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

39) In the United States in 2010, a family of four was considered to be living below the poverty line only if its household income was less than approximately

A) $400 per year.

B) $4,000 per year.

C) $11,900 per year.

D) $22,800 per year.

E) $35,800 per year.

Answer: D

Topic: Poverty

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: Revised

AACSB: Reflective thinking

40) In the United States in 2010, the Census Bureau determined that approximately ________ million Americans lived in households that had incomes below the poverty line.

A) 46

B) 22

C) 84

D) 11

E) 112

Answer: A

Topic: Poverty

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: Revised

AACSB: Reflective thinking

41) In 2010, the poverty rate in the United States level was approximately ________ percent.

A) 3

B) 15

C) 32

D) 20

E) 26

Answer: B

Topic: Poverty

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: Revised

AACSB: Reflective thinking

42) Looking at the U.S. poverty rate by race, we see that

A) the poverty rates by race are now equal.

B) whites have a higher poverty rate than do blacks.

C) Hispanics and blacks have a higher poverty rate than whites.

D) whites have a nearly zero poverty rate while Hispanics and blacks are near 20 percent.

E) whites and blacks have higher poverty rates than do Hispanics.

Answer: C

Topic: Poverty

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

43) Which type of household has the lowest poverty rate?

A) black

B) Hispanic

C) white

D) White and Hispanic are almost tied.

E) White and black are almost tied.

Answer: C

Topic: Poverty

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: SB

AACSB: Reflective thinking

44) Which of the following is correct about the United States?

A) Income is equally distributed.

B) Wealth is equally distributed.

C) Income is equally distributed but wealth is unequally distributed because of inheritances.

D) Both wealth and income are unequally distributed.

E) Both wealth and income are equally distributed.

Answer: D

Topic: Inequality in the United States

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: STUDY GUIDE

AACSB: Reflective thinking

45) If the income distribution is more unequal than the wealth distribution, then the

A) Lorenz curve for income will be farther away from the line of equality than the Lorenz curve for wealth.

B) government has imposed a higher tax rate on income.

C) Lorenz curve for wealth will be farther away from the line of equality than the Lorenz curve for income.

D) Lorenz curve for wealth will lie above the Lorenz curve for income.

E) It is not possible to draw the Lorenz curve for wealth on the same figure with the Lorenz curve for income.

Answer: A

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: STUDY GUIDE

AACSB: Reflective thinking

46) In the United States since 1970, the share of money income received by the richest 20 percent of households has ________ and the share of income received by the lowest 20 percent of households has ________.

A) increased; not changed

B) not changed; increased

C) not changed; decreased

D) decreased; increased

E) increased; decreased

Answer: E

Topic: Economic mobility

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: STUDY GUIDE

AACSB: Reflective thinking

47) In the United States in 2004, the wealthiest 1 percent of households held approximately ________ percent of all wealth.

A) 1

B) 13

C) 27

D) 34

E) 88

Answer: D

Topic: Inequality in the United States, wealth

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: STUDY GUIDE

AACSB: Reflective thinking

48) Of all the characteristics that lead to income inequality, the factor with the largest impact is

A) race.

B) sex.

C) age.

D) education.

E) location.

Answer: D

Topic: Income distribution by characteristic

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: STUDY GUIDE

AACSB: Reflective thinking

49) The inequality of annual income

A) overstates the amount of lifetime inequality.

B) understates the amount of lifetime inequality.

C) cannot change from one year to the next.

D) is about the same as the amount of lifetime inequality.

E) cannot be compared to the amount of lifetime inequality.

Answer: A

Topic: Annual versus lifetime income

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: STUDY GUIDE

AACSB: Reflective thinking

50) Which of the following statements about poverty is (are) correct?

i. Blacks and Hispanics have higher poverty rates than whites.

ii. Over the last 40 years, poverty rates for all groups have generally increased.

iii. Most household spells of poverty last well beyond 9 months.

A) i only

B) ii only

C) iii only

D) ii and iii

E) i, ii, and iii

Answer: A

Topic: Poverty

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: STUDY GUIDE

AACSB: Reflective thinking

20.2 How Economic Inequality Arises

1) Workers who have invested in education and training

A) are more likely to find jobs that are not rewarding.

B) have a higher value of marginal product.

C) have a more difficult time finding a job because their wage rate is higher.

D) have identical supply curves to otherwise similar workers who have not invested in education and training.

E) None of the above answers is correct.

Answer: B

Topic: Demand for high-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: SA

AACSB: Reflective thinking

2) The demand for labor

i. depends on the availability of labor.

ii. decreases when the supply of labor increases.

iii. depends on the value of marginal product of labor.

A) i only

B) i and ii

C) iii only

D) i and iii

E) i, ii, and iii

Answer: C

Topic: Demand for high-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: SA

AACSB: Reflective thinking

3) One reason why economists earn more than Taco Bell workers is because economists have a ________ value of marginal product of labor than Taco Bell workers.

A) lower

B) higher

C) similar

D) more convex

E) more concave

Answer: B

Topic: Demand for high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: JC

AACSB: Reflective thinking

4) The gap between the salary of Tom Cruise and an unknown actor is over $15 million per movie. This difference means that Mr. Cruise's value of marginal product is

A) over $15 million greater than the value of the marginal product of the unknown actor.

B) less than $15 greater than value of the marginal product of the unknown actor.

C) $15 million greater than the value of the marginal product of the unknown actor.

D) equal to the value of the marginal product of the unknown actor.

E) More information is need to make the comparison.

Answer: A

Topic: Demand for high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: JC

AACSB: Analytical reasoning

5) If a firm is willing to pay a high-skilled worker $25 per hour and a low-skilled worker $10 per hour then the value of marginal product of skill is

A) $15.

B) $40.

C) $10.

D) $25

E) There is not enough information to answer this question.

Answer: A

Topic: Demand for high-skilled labor

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

6) Which of the following is true? At a given quantity of employment, if the

i. value of marginal product of a high-skill worker is $35 and the value of marginal product of a low-skill worker is $10, the value of marginal product of the skill is $25.

ii. value of marginal product of a high-skill worker is $35 and the value of marginal product of a low-skill worker is $10, the cost of acquiring the skill is $25.

iii. value of marginal product of a skill is $25, then the wage rate must be $25.

A) i only

B) ii only

C) iii only

D) i and iii

E) ii and iii

Answer: A

Topic: Demand for high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: SA

AACSB: Reflective thinking

7) Which of the following is (are) a difference between high-skilled workers and low-skilled workers?

i. High-skilled workers have a higher value of marginal product.

ii. High-skilled workers have incurred lower opportunity costs to acquire their skills.

iii. The demand for high-skilled workers exceeds that for low-skilled workers.

A) i only

B) ii and iii

C) i and ii

D) i and iii

E) i, ii, and iii

Answer: D

Topic: Demand for high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: TS

AACSB: Reflective thinking

8) The demand curve for high-skilled workers

A) lies to the right of the demand curve for low-skilled workers.

B) lies to the left of the demand curve for low-skilled workers.

C) is vertical.

D) is horizontal.

E) lies to the right of the demand curve for low-skilled workers at high wages and to the left of the demand curve for low-skilled workers at low wages.

Answer: A

Topic: Demand for high-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: SB

AACSB: Reflective thinking

9) Suppose a supply curve for high-skilled labor is drawn in the same graph as a supply curve for low-skilled labor. The vertical distance between these two curves represents the

A) wage rate paid to a high-skilled worker.

B) wage rate paid to a low-skilled worker.

C) compensation the high-skilled worker requires for the cost of acquiring the skill.

D) number of high-skill workers that will be hired.

E) difference in the value of marginal product between the high-skilled workers and the low-skilled workers.

Answer: C

Topic: Supply of high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: SB

AACSB: Reflective thinking

10) Skills are costly to acquire. What forms do these costs take?

i9rnings while attending higher education

A) i only

B) ii only

C) iii only

D) i and iii

E) i, ii, and iii

Answer: D

Topic: Supply of high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: TS

AACSB: Reflective thinking

11) How does the supply curve of high-skilled workers compare to the supply curve of low-skilled workers?

A) Because skills are costly to acquire, at a given wage rate the quantity supplied of high-skilled workers is greater than that of low-skilled workers.

B) Because skills are costly to acquire, at any given wage rate the quantity supplied of high-skilled workers is less than that of low-skilled workers.

C) Because skills are inexpensive to acquire, at any given wage rate the quantity supplied of high-skilled workers is less than that of low-skilled workers.

D) Because skills are inexpensive to acquire, at any given wage rate the quantity supplied of high-skilled workers is greater than that of low-skilled workers.

E) None of the above answers is correct.

Answer: B

Topic: Supply of high-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: PH

AACSB: Reflective thinking

12) What determines the position of the supply curve of high-skilled workers relative to that of low-skilled workers?

A) the cost of acquiring the skill

B) the difference in the demand curves for the two groups

C) Bureau of Labor Standard guidelines

D) the difference in the value of the marginal products

E) None of the above answers is correct.

Answer: A

Topic: Supply of high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: TS

AACSB: Reflective thinking

13) The ________ distance between the supply curve of low-skilled labor and the supply curve of high-skilled labor is the ________.

A) horizontal; value of marginal product of skill

B) horizontal; compensation for cost of acquiring skill

C) vertical; value of marginal product of skill

D) vertical; compensation for cost of acquiring skill

E) vertical; difference in the price of the product produced b y high-skilled labor minus the price of the product produced by low-skilled labor

Answer: D

Topic: Supply of high-skilled labor

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

14) The higher the cost of acquiring skills, the ________ are the high-skilled and low-skilled labor ________ curves.

A) closer together; demand

B) farther apart; demand

C) closer together; supply

D) farther apart; supply

Answer: D

Topic: Supply of high-skilled labor

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Reflective thinking

15) Pete just started a new job as an assembler and is earning a wage of $10 per hour. Sam, who is an experienced assembler assigned to train Pete, earns $15 per hour. The opportunity cost to Pete of acquiring this skill is

A) $25 per hour.

B) $15 per hour.

C) $10 per hour.

D) $5 per hour.

E) $0 per hour because Pete is being paid a wage.

Answer: D

Topic: Supply of high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: SB

AACSB: Reflective thinking

16) High-skilled workers earn more relative to low-skilled workers because the demand for high-skilled workers is ________ that for low-skilled workers and the supply is ________ that for low-skilled workers.

A) greater than; greater than

B) greater than; lower than

C) lower than; greater than

D) lower than; lower than

E) greater than; the same as

Answer: B

Topic: High-skilled and low-skilled wages

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: SB

AACSB: Reflective thinking

17) The demand curve for high-skilled workers lies ________ the demand curve for low-skilled workers and the supply curve of high-skilled workers lies ________ the supply curve of low-skilled workers.

A) above; above

B) above; below

C) below; above

D) below; below

E) above; on

Answer: A

Topic: High-skilled and low-skilled wages

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: WM

AACSB: Reflective thinking

18) High-skilled workers earn more than low-skilled workers in part because the high-skilled workers have

A) a higher value of marginal product.

B) a lower value of marginal product.

C) better health.

D) fewer deductions.

E) a greater supply than do low-skilled workers.

Answer: A

Topic: High-skilled and low-skilled wages

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: SB

AACSB: Reflective thinking

19) Compared to low-skilled workers, high-skilled workers have a ________ value of marginal product and ________ opportunity cost of obtaining their skills.

A) higher; a higher

B) higher; a lower

C) lower; a higher

D) lower; a lower

E) higher; the same

Answer: A

Topic: High-skilled and low-skilled wages

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: WM

AACSB: Reflective thinking

20) The ________ the value of marginal product of skill, the ________.

A) smaller; larger is the wage differential between low-skilled workers and high-skilled workers

B) larger; more elastic the supply curve of labor

C) larger; larger is the wage differential between low-skilled workers and high-skilled workers

D) smaller; less elastic the supply curve of labor

E) smaller; larger is the cost of acquiring the skill

Answer: C

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: CD

AACSB: Analytical reasoning

21) The larger the value of marginal product of a skill, the

A) larger the vertical difference between the demand curves for high- and low-skilled labor.

B) smaller the vertical difference between the demand curves for high- and low-skilled labor.

C) larger the vertical distance between the supply curves for high- and low-skilled labor.

D) smaller the vertical distance between the supply curves for high- and low-skilled labor.

E) higher is the wage rate at which the demand curve for high-skilled workers crosses the demand curve for low-skilled workers.

Answer: A

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Reflective thinking

22) The more costly it is to acquire a skill, the

A) more people will go to school to learn the skill.

B) less employers are willing to pay for the skill.

C) greater the wage differential between high-skilled and low-skilled workers.

D) smaller the wage differential between high-skilled and low-skilled workers.

E) the demand for workers with that skill exceeds the demand for workers without that skill.

Answer: C

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

23) The rates of return on high school and college educations have

A) not been estimated, but are assumed to be high.

B) been estimated as negative, but these are still good options for most.

C) been estimated at 50 percent per year.

D) been estimated at between 5 to 10 percent per year.

E) been estimated to be essentially zero.

Answer: D

Topic: Eye on the U.S. economy, does education pay?

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: MR

AACSB: Reflective thinking

24) Discrimination by customers creates a wage differential between two groups by creating a difference in the two groups'

A) supply of labor.

B) value of marginal product.

C) marginal cost of labor.

D) minimum wage.

E) opportunity cost of acquiring skills.

Answer: B

Topic: Discrimination

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: MR

AACSB: Reflective thinking

25) Increased discrimination results in ________ of the workers discriminated against being hired and being paid ________ wage rates.

A) more; higher

B) more; lower

C) fewer; higher

D) fewer; lower

E) the same number; lower

Answer: D

Topic: Discrimination

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: WM

AACSB: Reflective thinking

26) If buyers discriminate against women and minorities,

i. the value of marginal product of women and minorities is less than otherwise.

ii. the wage rate paid to women and minorities is less than otherwise.

iii. more women and minorities are hired than otherwise.

A) i only

B) ii only

C) ii and iii

D) i and ii

E) i, ii, and iii

Answer: D

Topic: Discrimination

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: SA

AACSB: Reflective thinking

27) What economic effect works to eliminate sex and race discrimination?

A) Firms hire only the preferred races and sex.

B) Lower paid races and sexes give up working and drop out of the labor supply.

C) Customers who discriminate pay higher prices to buy from preferred races and sex.

D) The value of marginal product of the less preferred races and sexes eventually increases.

E) Lower paid races and sexes decrease their demand for goods and services.

Answer: C

Topic: Discrimination

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: TS

AACSB: Reflective thinking

28) Looking at wage differentials between white men and other groups in the United States, we see that

A) white men and black men earn about the same but women of all races earn less.

B) white men earn more than black men but white women earn less than black men.

C) black men earn less than white men and less than white women.

D) white men and white women earn about the same but minorities earn less.

E) black men and men of Hispanic origin earn about the same amount and both groups of men are paid more than black women and women of Hispanic origin.

Answer: C

Topic: Eye on the U.S. economy, sex and race earnings differences

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: WM

AACSB: Reflective thinking

29) Looking at wage differentials between white women and white men in the United States since 2000, we see that the amount of the difference

A) has not changed.

B) has increased.

C) has decreased.

D) at first increased but in the last decade it decreased.

E) at first decreased but in the last decade it increased.

Answer: C

Topic: Eye on the U.S. economy, sex and race earnings differences

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: MR

AACSB: Reflective thinking

30) Which of the following is correct? On the average,

i. the wage differential between white males and white females has narrowed since 2000.

ii. black females are paid more than black males.

iii. Hispanic males are paid more than black males.

A) i only

B) ii only

C) ii and iii

D) i and iii

E) i, ii, and iii

Answer: A

Topic: Eye on the U.S. economy, sex and race earnings differences

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: Revised

AACSB: Reflective thinking

31) Differences in skills

i. can arise partly from differences in education and/or partly from differences in on-the-job training.

ii. can lead to large differences in earnings.

iii. result in different demand curves for high-skilled and low-skilled labor.

A) i only

B) ii only

C) ii and iii

D) i and iii

E) i, ii, and iii

Answer: E

Topic: Demand for high-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: STUDY GUIDE

AACSB: Reflective thinking

32) Other things being equal, the demand curve for low-skilled workers ________ the demand curve for high-skilled workers.

A) lies below

B) lies above

C) is the same as

D) is not comparable to

E) at high wages lies below and at low wages lies above

Answer: A

Topic: Demand for low-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: STUDY GUIDE

AACSB: Analytical reasoning

33) The cost of acquiring a skill accounts for why the

A) demand for high-skilled workers is different from the demand for low-skilled workers.

B) supply of high-skilled workers is different from the supply of low-skilled workers.

C) demand for high-skilled workers is different from the supply of high-skilled workers.

D) demand for high-skilled workers is different from the supply of low-skilled workers.

E) supply curves of high-skilled and low-skilled workers cross.

Answer: B

Topic: Supply of high-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: STUDY GUIDE

AACSB: Reflective thinking

34) The vertical distance between the supply curves for neurosurgeons and the supply curve for fast-food servers

A) represents the difference in the demand for these two occupations.

B) is the compensation that neurosurgeons require for the cost of acquiring this skill.

C) is the difference in the value of marginal product of the two professions.

D) is the difference in on-the-job training.

E) equals the difference in the equilibrium wages paid these two professions.

Answer: B

Topic: Supply of high-skilled labor

Skill: Level 1: Definition

Section: Checkpoint 20.2

Status: STUDY GUIDE

AACSB: Analytical reasoning

35) The wage rate that high-skilled workers receive is ________ the wage rate that low-skill workers receive.

A) greater than or equal to

B) equal to

C) less than or equal to

D) greater than

E) less than

Answer: D

Topic: Supply of high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: STUDY GUIDE

AACSB: Reflective thinking

36) If discrimination against women decreases their value of marginal product, then women will have ________ wage rate than men and there will be ________ high-paying jobs for women.

A) a lower; more

B) a higher; fewer

C) a lower; fewer

D) a higher; more

E) the same; fewer

Answer: C

Topic: Discrimination

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: STUDY GUIDE

AACSB: Analytical reasoning

37) Inequality in the distribution of income and wealth is increased by

A) the point that the children of the poorest find it difficult to get into college.

B) saving to redistribute an uneven income over the life cycle.

C) marrying outside one's own socioeconomic class.

D) donating money to charities.

E) the U.S. income tax.

Answer: A

Topic: Choices

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: STUDY GUIDE

AACSB: Reflective thinking

20.3 Income Redistribution

1) The three main ways that governments in the United States redistribute income are

A) using the rule of law, subsidized services, and income taxes.

B) private property rights, income taxes and the minimum wage.

C) income taxes, income maintenance programs, and subsidized services.

D) income taxes, rent control, and food stamps.

E) sales taxes, food stamps, and subsidized services.

Answer: C

Topic: Income redistribution

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: JC

AACSB: Reflective thinking

2) Which of the following currently helps redistribute income in the United States?

i. negative income tax

ii. progressive income taxes

iii. Social Security

A) ii and iii

B) i and ii

C) i and iii

D) i, ii, and iii

E) iii only

Answer: A

Topic: Income redistribution

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: CD

AACSB: Reflective thinking

3) A progressive income tax is a tax for which the average tax rate

A) increases as income increases.

B) becomes negative as income decreases.

C) decreases as income increases.

D) stays the same regardless of the income level.

E) first slowly decreases and then rapidly increases as income increases.

Answer: A

Topic: Taxes

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: PH

AACSB: Reflective thinking

4) A tax is progressive if the average tax rate

A) increases as income increases.

B) increases as income decreases.

C) is negative.

D) is positive.

Answer: A

Topic: Taxes

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: MR

AACSB: Reflective thinking

5) A ________ tax is one that taxes income at an average rate that decreases with the level of income.

A) regressive

B) progressive

C) flat

D) social security

E) proportional

Answer: A

Topic: Taxes

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: JC

AACSB: Reflective thinking

6) A regressive income tax is a tax for which the average tax rate

A) increases as income increases.

B) becomes negative as income decreases.

C) decreases as income increases.

D) stays the same regardless of the income level.

E) first increases and then decreases as income increases.

Answer: C

Topic: Taxes

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: PH

AACSB: Reflective thinking

7) A ________ has a constant tax rate regardless of the level of income.

A) regressive tax

B) progressive tax

C) state tax

D) proportional tax

E) subsidy tax

Answer: D

Topic: Taxes

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: PH

AACSB: Reflective thinking

8) In the United States, the federal and state income tax system is

A) progressive.

B) proportional.

C) regressive.

D) a flat-rate tax.

E) None of the above answers is correct.

Answer: A

Topic: Taxes

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: SA

AACSB: Reflective thinking

9) Which of the following is(are) an example of an income maintenance program?

i. unemployment compensation

ii. welfare programs

iii. social security programs

A) i and iii

B) ii and iii

C) iii only

D) i and ii

E) i, ii, and iii

Answer: E

Topic: Income maintenance programs

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: TS

AACSB: Reflective thinking

10) Three types of income maintenance programs used by the United States are

A) income taxes, Social Security, and the earned income tax credit.

B) Social Security programs, OASDHI, and income taxes.

C) Social Security programs, unemployment compensation, and welfare programs.

D) welfare programs, income taxes, and the earned income tax credit.

E) income taxes, Social Security, and subsidized services.

Answer: C

Topic: Income maintenance programs

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: WM

AACSB: Reflective thinking

11) Social Security is a ________ program paid for by ________.

A) compulsory; payroll taxes

B) compulsory; government money

C) voluntary; payroll taxes

D) voluntary; income taxes

E) compulsory; voluntary taxes on income

Answer: A

Topic: Income maintenance programs

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: JC

AACSB: Reflective thinking

12) Social Security and unemployment compensation

A) are paid only to the poorest households.

B) are both funded by income taxes.

C) are distributed by individual states.

D) both redistribute income.

E) make the distribution of income less equal.

Answer: D

Topic: Income maintenance programs

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: CD

AACSB: Reflective thinking

13) ________ is a component of welfare programs.

A) A progressive income tax

B) Unemployment compensation

C) Medicaid

D) Social Security payroll taxes

E) The negative income tax

Answer: C

Topic: Income maintenance programs

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: CD

AACSB: Reflective thinking

14) Looking at the results of government income redistribution programs, we find that the income received by the

A) lowest 20 percent of households is almost unchanged because most don't work.

B) highest 20 percent is left unaffected because they are able to shelter income from taxes.

C) lowest 20 percent increases and the income received by the highest 20 percent decreases.

D) lowest 20 percent increases somewhat but the income received by the next 20 percent increases the most.

E) lowest 20 percent decreases because of government taxes and the income received by the highest 20 percent increases because of government subsidies.

Answer: C

Topic: Sources of income

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: WM

AACSB: Reflective thinking

15) Passing the TANF welfare program has

A) has made welfare programs more open-ended entitlement programs.

B) limited assistance to five years.

C) eliminated work and public service requirements.

D) hurt economic incentives to work.

E) made it into a negative income tax program.

Answer: B

Topic: Welfare trap

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: SB

AACSB: Reflective thinking

16) A negative income tax is a system that, in part,

A) taxes lower-income households at a higher rate.

B) taxes higher-income households at a higher rate.

C) guarantees a minimum level of income for all households.

D) gives money from taxes paid by the poor to wealthy investors.

E) guarantees a minimum level of taxation for all households.

Answer: C

Topic: Negative income tax

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: WM

AACSB: Reflective thinking

17) Which of the following characterizes the negative income tax concept?

A) It is a flat tax that lower-income households do not pay.

B) It is a progressive tax structure with enough deductions to provide refunds to some.

C) It is a regressive tax with low-income earners getting a refund back when taxes are filed.

D) It is a guaranteed annual income with earned incomes taxed at a flat rate.

E) It is an income tax that eliminates all the inefficiency that occurs with the current tax system.

Answer: D

Topic: Negative income tax

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: TS

AACSB: Reflective thinking

18) A negative income tax

A) is a regressive income tax.

B) is currently in use in the United States.

C) makes the redistribution of income efficient.

D) provides every household with a guaranteed minimum annual income.

E) cannot be enacted in the United States because it is unconstitutional.

Answer: D

Topic: Negative income tax

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: CD

AACSB: Reflective thinking

19) With a negative income tax that has a $10,000 guaranteed income and a 25 percent tax rate, a household that has a market income of $4,000 has a total income of

A) $15,000.

B) $14,000.

C) $13,000.

D) $10,000.

E) $7,000.

Answer: C

Topic: Negative income tax

Skill: Level 3: Using models

Section: Checkpoint 20.3

Status: MR

AACSB: Analytical reasoning

20) Which of the following is a way income is redistributed in the United States?

i. subsidizing services

ii. income taxes

iii. income maintenance programs

A) i only

B) ii only

C) ii and iii

D) i and iii

E) i, ii, and iii

Answer: E

Topic: Redistribution

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: STUDY GUIDE

AACSB: Reflective thinking

21) A ________ tax is one that taxes income at an average rate that increases with the level of income.

A) regressive

B) progressive

C) flat

D) consumption

E) proportional

Answer: B

Topic: Taxes

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: STUDY GUIDE

AACSB: Reflective thinking

22) Of the following types of income tax systems, the one that provides the greatest amount of redistribution from the rich to the poor is a

A) progressive income tax.

B) proportional income tax.

C) regressive income tax.

D) flat-rate income tax.

E) money-income tax.

Answer: A

Topic: Taxes

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: STUDY GUIDE

AACSB: Reflective thinking

23) The three major types of income maintenance programs are

A) Social Security programs, unemployment compensation, and welfare programs.

B) food stamps, unemployment compensation, and agricultural price supports.

C) student loans, rent control, and welfare programs.

D) corporate welfare, minimum wages, and affirmative action laws.

E) minimum wages, food stamps, and student loans.

Answer: A

Topic: Income maintenance programs

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: STUDY GUIDE

AACSB: Reflective thinking

24) A household's income earned from the markets for factors of production and with no government redistribution is

A) money income.

B) welfare.

C) market income.

D) exploitative income.

E) factored income.

Answer: C

Topic: Market income, money income

Skill: Level 1: Definition

Section: Checkpoint 20.3

Status: STUDY GUIDE

AACSB: Reflective thinking

25) When government redistributes income, one dollar collected from a rich person translates into ________ received by a poor person.

A) exactly one dollar

B) less than one dollar

C) more than one dollar

D) zero dollars

E) either exactly one dollar or, with some programs, more than one dollar

Answer: B

Topic: Big tradeoff

Skill: Level 2: Using definitions

Section: Checkpoint 20.3

Status: STUDY GUIDE

AACSB: Reflective thinking

26) With a negative income tax that has a $10,000 guaranteed minimum income and a 25 percent tax rate, a household that has earned income of $16,000 has a total income of

A) $16,000.

B) $22,000.

C) $26,000.

D) $24,000.

E) $10,000.

Answer: B

Topic: Negative income tax

Skill: Level 3: Using models

Section: Checkpoint 20.3

Status: STUDY GUIDE

AACSB: Analytical reasoning

20.4 Chapter Figures

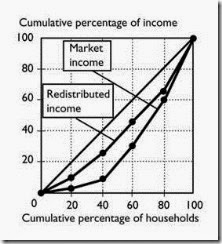

The figure above shows Lorenz curves for a nation.

1) Based on the figure above, if the poorest 20 percent group of households increased the share of the nation's income they receive, then

A) there is a movement up along the Lorenz curve for income.

B) there is a movement down along the Lorenz curve for income.

C) the Lorenz curve for income shifts toward the line of equality.

D) the Lorenz curve for income shifts away from the line of equality.

E) Both answers A and C are correct.

Answer: C

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

2) Based on the figure above,

A) the average household's income exceeds its wealth.

B) the average household's wealth exceeds its income.

C) income is distributed more equally than wealth.

D) wealth is distributed more equally than income.

E) Both answers A and C are correct.

Answer: C

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

3) Based on the figure above,

A) wealth is distributed more equally than income.

B) the Lorenz curve for wealth shows that the poorest 40 percent of households receive about 40 percent of the nation's wealth.

C) average income exceeds average wealth.

D) average wealth exceeds average income.

E) the Lorenz curve for income shows that the richest 20 percent of households receive about 50 percent of the nation's income.

Answer: E

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

4) Based on the figure above, which of the following can cause a movement from point C to point D on the Lorenz curve for income?

A) an increase in income for the bottom 60 percent of households

B) an increase in income for the bottom 80 percent of households

C) a decrease in income for the bottom 60 percent of households

D) a decrease in income for the bottom 80 percent of households

E) None of the above answers is correct.

Answer: E

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: MR

AACSB: Analytical reasoning

The figure above shows the demand and supply curves for high-skilled (indicated by an "H" subscript) and low-skilled (indicated by an "L" subscript) workers.

5) In the figure above, the value of the marginal product of skill creates the difference between the ________ curves and ________.

A) SL and SH; is equal to $10 per hour

B) SL and SH; exceeds $10 per hour

C) DL and DH; is less than $10 per hour

D) DL and DH; is equal to $10 per hour

E) DL and DH; exceeds $10 per hour

Answer: E

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

6) In the figure above, the compensation for the cost of acquiring the skill creates the difference between the ________ curves and ________.

A) SL and SH; is equal to $10 per hour

B) SL and SH; is less than $10 per hour

C) DL and DH; is less than $10 per hour

D) DL and DH; is equal to $10 per hour

E) SL and SH; exceeds $10 per hour

Answer: B

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

7) In the figure above, the equilibrium wage differential between high-skilled workers and low-skilled workers is

A) zero.

B) $5.00 or less per hour.

C) between $5.01 and $10.00 per hour.

D) between $10.01 and $20.00 per hour.

E) more than $20.01 per hour.

Answer: C

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

8) In the figure above, if the value of the marginal product of skill increased, then the

A) SL curve shifts leftward.

B) SH curve shifts leftward.

C) DH curve shifts rightward.

D) DH curve shifts leftward.

E) DL curve shifts leftward.

Answer: C

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

9) In the figure above, if the cost of acquiring the skill decreased, then the

A) SL curve shifts leftward.

B) SH curve shifts leftward.

C) SH curve shifts rightward.

D) DH curve shifts leftward.

E) DL curve shifts leftward.

Answer: C

Topic: High-skilled and low-skilled wages

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: MR

AACSB: Analytical reasoning

20.5 Integrative Questions

1) The wage differential between high-skilled and low-skilled workers is the result of

A) a difference in the value of marginal product.

B) the cost of acquiring skills.

C) a negative income tax.

D) Both answers A and B are correct.

E) Both answers B and C are correct.

Answer: D

Topic: Integrative

Skill: Level 3: Using models

Section: Integrative

Status: CD

AACSB: Reflective thinking

2) Discrimination

A) can be corrected by imposing a negative income tax.

B) cannot explain economic inequality.

C) immediately results in an unequal ownership of capital.

D) is more likely to occur in a business where customers come into contact with minority employees.

E) means that the costs paid by people who discriminate are lower than otherwise.

Answer: D

Topic: Integrative

Skill: Level 4: Applying models

Section: Integrative

Status: CD

AACSB: Reflective thinking

3) Which of the following statements correctly describes how taxes redistribute income across different households in an economy?

A) The richest 40 percent of households increase their share of income.

B) The poorest 60 percent of households increase their share of income.

C) Taxes have no effect on the distribution of income.

D) The poorest 20 percent of households receive 20 percent of their income from the government.

E) The richest 20 percent of households increase their share of income and the poorest 20 percent decrease their share of income.

Answer: B

Topic: Integrative

Skill: Level 2: Using definitions

Section: Integrative

Status: CD

AACSB: Reflective thinking

4) Suppose a state charges an in-state student $2000 in tuition for a college education and charges an out-of -state student $10,000 in tuition. This differential

A) is a result of the state subsidizing education for its residents.

B) explains the difference between the demand curve for high-skilled and low-skilled labor.

C) explains the difference between the supply curve for high-skilled and low-skilled labor.

D) can be corrected via a negative income tax.

E) is an example of the positive theories of income redistribution.

Answer: A

Topic: Integrative

Skill: Level 4: Applying models

Section: Integrative

Status: CD

AACSB: Reflective thinking

20.6 Essay: Measuring Economic Inequality

1) What is the difference between wealth and income?

Answer: Wealth is a stock of assets, that is, wealth is what is owned at a point in time. Income is a flow of earnings over time. Thus a person's wealth can be measured on, say December 31, 2012 whereas a person's income is measured over a time period, say during 2012.

Topic: Wealth versus income

Skill: Level 1: Definition

Section: Checkpoint 20.1

Status: SB

AACSB: Reflective thinking

2) In the United States, do the poorest 20 percent of the households receive more or less than 5 percent of money income?

Answer: The poorest 20 percent of households receive less than 5 percent of money income.

Topic: Inequality in the United States

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: AA

AACSB: Reflective thinking

3) Which is distributed more equally: income or wealth?

Answer: The income distribution is much more equal than the wealth distribution. The poorest 40 percent of wealth holders own only 0.2 percent of wealth and the richest 20 percent own about 85 percent of wealth. For income, the poorest 40 percent of households receive about 12 percent of money income and the richest 20 percent of households receive about 50 percent of money income.

Topic: Inequality in the United States

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: AA

AACSB: Communication

4) What is a Lorenz curve?

Answer: A Lorenz curve is a curve that graphs the cumulative percentage of income (or wealth) against the cumulative percentage of households. The further the Lorenz curve is from the 45° line measuring equal incomes (or wealth), the greater the inequality of income (or wealth).

Topic: Lorenz curve

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: JC

AACSB: Reflective thinking

5) "If the distribution of income was equal, the Lorenz curve would be a straight, 45° line." Is the previous statement correct or incorrect?

Answer: The statement is correct.

Topic: Lorenz curve

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: WM

AACSB: Reflective thinking

6) What do the Lorenz curves for wealth and income in the United States look like? Which is closer to the line of equality?

Answer: Both the Lorenz curve for wealth and the Lorenz curve for income are bowed outward from the line of equality because neither wealth nor income is equally distributed. The Lorenz curve for income is closer to line of equality than the Lorenz curve for wealth because income, while unequally distributed, is more equally distributed than is wealth.

Topic: Lorenz curve

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: AA

AACSB: Communication

7) "Over the past two decades, the distribution of income in the United States has become more equal." Is the previous statement correct or incorrect? Briefly explain your answer.

Answer: The statement is incorrect. In recent years, higher income groups have gained relatively more than the lower income groups. The share of income going to the richest 20 percent of households has increased and so the share of income going to the other 80 percent of households has decreased.

Topic: Inequality over time

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: TS

AACSB: Communication

8) Of age, marital status, family size, education, and race, which is the single biggest factor affecting the household income distribution?

Answer: The single most important factor affecting the distribution of income is education, with more highly educated people earning significantly more than less-educated people.

Topic: Income distribution by characteristic

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: TS

AACSB: Reflective thinking

9) Describe the characteristics of the typical lowest income household in the United States and the characteristics of the typical richest household in the United States.

Answer: The typical lowest income household has less than a 9th grade education, is headed by single black woman over 65. The family lives in the South. The highest income household lives in the West. It is headed white married couple between 45 and 54 years of age. Both parents have college educations. The family has two children.

Topic: Income distribution by characteristic

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: CD

AACSB: Communication

10) Is the poverty rate the lowest among Hispanic households, black households, or white households?

Answer: The poverty rate is lowest among white households. About 12 percent of white households live in poverty whereas about 25 percent of Hispanic and black households live in poverty.

Topic: Poverty

Skill: Level 2: Using definitions

Section: Checkpoint 20.1

Status: Revised

AACSB: Reflective thinking

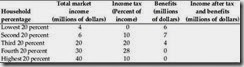

11) The above table shows the distribution of income in two imaginary countries, Alpha and Beta.

a. What does the table tell you about the second 20 percent group in each country?

b. Calculate the cumulative percentage for both countries.

c. Interpret the cumulative percentage for the third 20 percent group in both countries.

Answer:

a. The second 20 percent group earns 10 percent of the income in country Alpha and 6 percent of the income in country Beta.

b. The table above has the cumulative percentages.

c. In country Alpha, the poorest 60 percent of households earns 35 percent of income. In country Beta, the poorest 60 percent of households earns 21 percent of income.

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: SB

AACSB: Analytical reasoning

12) The above table shows the distribution of income in two imaginary countries, Alpha and Beta.

a. In the figure below, draw the Lorenz curves for Alpha and Beta.

b. Compare the distribution of income in Alpha with that in Beta. Which distribution is more unequal?

c. What would be the distribution of income in a country with perfect income equality?

Answer:

a. The Lorenz curves are above.

b. The distribution of income in Beta is more unequal than the distribution of income in Alpha because the Beta Lorenz curve lies further from the line of equality.

c. Each 20 percent group would earn 20 percent of the income, so the Lorenz curve would lie on the line of equality.

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: SB

AACSB: Analytical reasoning

13) The table above gives the average income received by each 20 percent group of households. Complete the table by finding the percentage of income earned by each group and the cumulative percentage of income. Label the figure below and then plot the Lorenz curve.

Answer:

The completed table is above. The Lorenz curve is below.

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: SA

AACSB: Analytical reasoning

14) The table above gives cumulative percent of income received by each 20 percent group of households. Label the figure below and then plot the Lorenz curves. In which nation is income more equally distributed?

Answer:

The Lorenz curves are above. Income is distributed more equally in Country A.

Topic: Lorenz curve

Skill: Level 3: Using models

Section: Checkpoint 20.1

Status: SA

AACSB: Analytical reasoning

20.7 Essay: How Economic Inequality Arises

1) What is "human capital" and why is it considered an investment?

Answer: Human capital is the accumulated skill and knowledge of human beings. The cost of acquiring skills, say by obtaining a college degree, require expenditures prior to earning a higher income. The higher income is the return for investing the time and money to obtain the degree. Whenever the return from an activity generates future streams of income, it can be considered an investment.

Topic: Human capital

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: PH

AACSB: Communication

2) What is "human capital"? How is it important in the determination of a worker's wage rate?

Answer: Human capital is the skill, education, and training that a person acquires. The more human capital a person has, the higher the person's productivity and hence the higher the person's value of the marginal product. A higher value of the marginal product increases the demand for the worker and leads to a higher wage rate.

Topic: Human capital

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: PH

AACSB: Communication

3) How is human capital acquired?

Answer: Human capital can be acquired either through formal education and/or through on-the-job training.

Topic: Human capital

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: TS

AACSB: Reflective thinking

4) How does the demand for high-skilled workers compare to the demand for low-skilled workers? Why does this difference exist?

Answer: The demand for high-skilled workers exceeds the demand for low-skilled workers because the value of marginal product of high-skilled workers exceeds the value of marginal product of low-skilled workers.

Topic: Demand for high-skilled labor

Skill: Level 2: Using definitions

Section: Checkpoint 20.2

Status: WM

AACSB: Reflective thinking

5) How does an increase in the cost to acquire a skill affect the vertical distance between the supply curves of high-skilled and low-skilled workers?

Answer: The vertical distance between the supply of high-skilled labor curve and the supply of low-skilled labor curve is the amount necessary to compensate high-skilled workers for the cost of acquiring the skill. An increase in the cost of acquiring the skill increases the amount needed to compensate the workers and so increases the vertical distance between the two supply curves.

Topic: Supply of high-skilled labor

Skill: Level 3: Using models

Section: Checkpoint 20.2

Status: PH

AACSB: Communication

6) At any wage rate, the quantity of welders willing to work is less than the quantity of tomato pickers. Why?

Answer: For the welder the cost of acquiring his or her skill is much higher than the cost incurred by the tomato picker. The cost of learning how to pick fruits and vegetables is so low that the supply of individuals who can do that activity is quite large. Welders must learn their trade on the job and/or through vocational training, which raises the costs of learning this skill and decreases the supply of welders.