Horngren's Accounting 10/E Solutions manual and test bank Matsumura, Nobles & Mattison

Horngren's Accounting, 10e (Nobles/Mattison/Matsumura)

Chapter 2 Recording Business Transactions

Learning Objective 2-1

1) A chart of accounts is a detailed record of the changes in a particular asset, liability, or owner's equity.

Answer: FALSE

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

2) A chart of accounts is a list of all of a company's accounts with their account numbers.

Answer: TRUE

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

3) Liabilities are economic resources that are expected to benefit the business in the future.

Answer: FALSE

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

4) A payment of an expense in advance is called a prepaid expense.

Answer: TRUE

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

5) An accounts receivable requires the business to pay cash in future.

Answer: FALSE

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

6) A payable involves a future receipt of cash.

Answer: FALSE

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

7) Unearned revenue is a liability account.

Answer: TRUE

Diff: 1

LO: 2-1

AACSB: Application

AICPA Functional: Measurement

8) The account title used for recording the prepayment of rent for a building in the future is:

A) prepaid rent.

B) rent payable.

C) rent revenue.

D) rent expense.

Answer: A

Diff: 1

LO: 2-1

AACSB: Application

AICPA Functional: Measurement

9) ________ represents a debt owed for renting a building currently.

A) Prepaid rent

B) Rent payable

C) Rent revenue

D) Rent expense

Answer: B

Diff: 1

LO: 2-1

AACSB: Application

AICPA Functional: Measurement

10) Nuptial Inc. paid the rent for the current month in cash. Which of the following account titles will be debited?

A) Prepaid rent

B) Rent payable

C) Rent revenue

D) Rent expense

Answer: D

Diff: 1

LO: 2-1

AACSB: Application

AICPA Functional: Measurement

11) Which of the following is a liability account?

A) Accounts Receivable

B) Cash

C) Building

D) Notes Payable

Answer: D

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

12) Which of the following is an asset account?

A) Wages Payable

B) Notes Payable

C) Unearned Revenue

D) Accounts Receivable

Answer: D

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

13) A customer's promise to pay in the future for services or goods sold is called a(n):

A) Accounts Receivable.

B) Accounts Payable.

C) Unearned Revenue.

D) Notes Payable.

Answer: A

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

14) Which of the following is a collection of all the accounts, the changes in those accounts, and their balances?

A) source document

B) journal

C) ledger

D) trial balance

Answer: C

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

15) Which of the following is an asset account?

A) Salaries Expense

B) Accounts Payable

C) Service Revenue

D) Prepaid Expense

Answer: D

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

16) Which of the following is a liability account?

A) Accounts Payable

B) Prepaid Expense

C) Salaries Expense

D) Service Revenue

Answer: A

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

17) The earnings that result from delivering goods or services to customers are called:

A) notes receivable.

B) unearned revenues.

C) capital.

D) revenues.

Answer: D

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

18) Which of the following details is provided in a typical chart of accounts?

A) account balance

B) account number

C) dates of transactions

D) transaction amounts

Answer: B

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

19) A liability created when a business collects cash from customers in advance of providing services or delivering goods is called:

A) notes receivable.

B) unearned revenues.

C) capital.

D) revenues.

Answer: B

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

20) Which of the following is a liability account?

A) Service Revenue

B) Building

C) Accounts Receivable

D) Unearned Revenue

Answer: D

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

21) A listing of all account titles in numerical order is called a(n):

A) ledger.

B) journal.

C) income statement.

D) chart of accounts.

Answer: D

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

22) Which of the following is an asset account?

A) Cash

B) Notes Payable

C) Owner's Withdrawals

D) Expenses

Answer: A

Diff: 2

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

23) Which type of account is Owner's Capital?

A) equity

B) asset

C) liability

D) revenue

Answer: A

Diff: 2

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

24) An amount owed but not paid is called a(n):

A) prepaid expense.

B) adjusted liability.

C) accrued liability.

D) note receivable.

Answer: C

Diff: 1

LO: 2-1

AACSB: Concept

AICPA Functional: Measurement

Learning Objective 2-2

1) Debit refers to the right side of the T-account and credit refers to the left side.

Answer: FALSE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

2) The system of accounting in which every transaction affects at least two accounts is called the double-entry system.

Answer: TRUE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

3) An asset account is increased by a debit.

Answer: TRUE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

4) The Owner's Capital account is increased by a debit.

Answer: FALSE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

5) The Owner's Withdrawals account is increased by a debit.

Answer: TRUE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

6) A liability account is increased by a debit.

Answer: FALSE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

7) An account that normally has a debit balance may occasionally have a credit balance.

Answer: TRUE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

8) All asset accounts and equity accounts increase with a debit.

Answer: FALSE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

9) The balances in the accounts of liabilities and revenues are increased with a credit.

Answer: TRUE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

10) The normal balance of an account is the increase side of the account.

Answer: TRUE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

11) When a business makes a cash payment, the Cash account is debited.

Answer: FALSE

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

12) When a business collects cash, the Cash account is debited.

Answer: TRUE

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

13) When a business records an expense incurred, the Expense account is credited.

Answer: FALSE

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

14) When a business records revenue earned, the Revenue account is credited.

Answer: TRUE

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

15) A debit always means a decrease and a credit means increase.

Answer: FALSE

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

16) Which of the following accounts increases with a credit?

A) Cash

B) Smith, Capital

C) Accounts Receivable

D) Prepaid Expenses

Answer: B

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

17) Which of the following accounts decreases with a credit?

A) Cash

B) Smith, Capital

C) Accounts Payable

D) Notes Payable

Answer: A

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

18) Which of the following accounts increases with a debit?

A) Cash

B) Interest Payable

C) Accounts Payable

D) Smith, Capital

Answer: A

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

19) Which of the following accounts decreases with a debit?

A) Accounts Receivable

B) Notes Payable

C) Cash

D) Land

Answer: B

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

20) Which of the following groups of accounts normally have a credit balance?

A) assets and liabilities

B) capital and assets

C) liabilities and owner's equity

D) assets and expenses

Answer: C

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

21) Which of the following groups of accounts normally have a debit balance?

A) assets and expenses

B) revenues and expenses

C) liabilities and owner's equity

D) assets and liabilities

Answer: A

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

22) Which of the following groups of accounts will decrease with a debit?

A) assets and expenses

B) revenues and expenses

C) liabilities and owner's equity

D) assets and liabilities

Answer: C

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

23) Which of the following statements is true of expenses?

A) Expenses increase owner's equity, so an expense account's normal balance is a credit balance.

B) Expenses decrease owner's equity, so an expense account's normal balance is a credit balance.

C) Expenses increase owner's equity, so an expense account's normal balance is a debit balance.

D) Expenses decrease owner's equity, so an expense account's normal balance is a debit balance.

Answer: D

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

24) The Accounts Receivable account is a(n) ________ account and carries a ________ normal balance.

A) liability; debit

B) asset; debit

C) liability; credit

D) asset; credit

Answer: B

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

25) The Accounts Payable account is a(n) ________ account and carries a ________ normal balance.

A) liability; debit

B) asset; debit

C) liability; credit

D) asset; credit

Answer: C

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

26) For the Cash account, the category of account and its normal balance is:

A) assets and a debit balance.

B) liabilities and a credit balance.

C) liabilities and a debit balance.

D) assets and a credit balance.

Answer: A

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

27) Which of the following statements is true of the Owner's Capital account?

A) It is an equity account that has a normal credit balance.

B) It is a liability account that has a normal credit balance.

C) It is a liability account that has a normal debit balance.

D) It is an equity account that has a normal debit balance.

Answer: A

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

28) For Office Supplies, the category of account and its normal balance is:

A) liabilities and a debit balance.

B) assets and a debit balance.

C) liabilities and a credit balance.

D) assets and a credit balance.

Answer: B

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

29) The Salaries Payable account is a(n):

A) liability account with a normal debit balance.

B) asset account with a normal debit balance.

C) liability account with a normal credit balance.

D) asset account with a normal credit balance.

Answer: C

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

30) For Expenses, the category of account and its normal balance is:

A) owner's equity and a credit balance.

B) assets and a debit balance.

C) assets and a credit balance.

D) owner's equity and a debit balance.

Answer: D

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

31) For Revenues, the category of account and its normal balance is:

A) owner's equity and a credit balance.

B) assets and a debit balance.

C) assets and a credit balance.

D) owner's equity and a debit balance.

Answer: A

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

32) For Owner's Capital, the category of account and its normal balance is:

A) equity and a credit balance.

B) assets and a debit balance.

C) equity and a debit balance.

D) assets and a credit balance.

Answer: A

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

33) Withdrawals is a(n) ________ account that has a normal ________ balance.

A) liability; credit

B) equity; debit

C) liability; debit

D) equity; credit

Answer: B

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

34) Which of the following statements is true of revenue?

A) Revenues decrease owner's equity, so a revenue account's normal balance is a credit balance.

B) Revenues decrease owner's equity, so a revenue account's normal balance is a debit balance.

C) Revenues increase owner's equity, so a revenue account's normal balance is a debit balance.

D) Revenues increase owner's equity, so a revenue account's normal balance is a credit balance.

Answer: D

Diff: 2

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

35) A shortened form of an account in the ledger is called a:

A) trial balance.

B) balance sheet.

C) chart of accounts.

D) T-account.

Answer: D

Diff: 1

LO: 2-2

AACSB: Concept

AICPA Functional: Measurement

36) The Accounts Receivable account of Nuptials Inc. is shown below.

Calculate the ending balance of the account.

A) $33,500, debit

B) $31,000, debit

C) $3,500, credit

D) $27,500, debit

Answer: D

Diff: 1

LO: 2-2

AACSB: Application

AICPA Functional: Measurement

Learning Objective 2-3

1) Source documents provide the evidence and data for accounting transactions.

Answer: TRUE

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

2) Debits in the journal are always posted as debits in the ledger.

Answer: TRUE

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

3) The process of transferring data from the ledger to the journal is called posting.

Answer: FALSE

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

4) A journal entry under the double-entry system includes both debit and credit amounts.

Answer: TRUE

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

5) Accountants first record transactions in a:

A) chart of accounts.

B) trial balance.

C) journal.

D) ledger.

Answer: C

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

6) Journalizing a transaction involves:

A) calculating the balance in an account using journal entries.

B) posting the account balances in the chart of accounts.

C) preparing a summary of account balances.

D) recording the data only in the journal.

Answer: D

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

7) Posting a transaction means:

A) calculating the balance in an account.

B) transferring data from the journal to the ledger

C) preparing a summary of account balances.

D) finding the account number in the chart of accounts.

Answer: B

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

8) After initially recording a transaction, the data is then transferred to the:

A) chart of accounts.

B) ledger.

C) trial balance.

D) journal.

Answer: B

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

9) The accounting process of transferring a transaction from the journal to the ledger is called:

A) journalizing.

B) posting.

C) compounding.

D) sourcing.

Answer: B

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

10) The first step in the journalizing and posting process is to:

A) post the accounts to the ledger.

B) identify each account involved and its type.

C) determine whether each account is increased or decreased.

D) record the transaction in the journal, including a brief explanation.

Answer: B

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

11) Which of the following is the order of steps to journalize an entry?

A) Identify each account affected → Determine increase or decrease in each account → Record the transaction

B) Identify each account affected → Record the transaction → Determine increase or decrease in each account

C) Record the transaction → Identify each account affected → Determine increase or decrease in each account

D) Determine increase or decrease in each account → Identify each account affected → Record the transaction

Answer: A

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

12) Which of the following is the fifth and last step in the journalizing and posting process?

A) posting the accounts to the ledger

B) identifying each account affected and its type

C) determining whether the accounting equation is in balance

D) determining whether each account has increased or decreased

Answer: C

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

13) Which of the following sequences is the normal sequence of flow of accounting data?

A) Ledger → Journal → Source document

B) Journal → Source document → Ledger

C) Source document → Journal → Ledger

D) Source document → Ledger → Journal

Answer: C

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

14) Which of the following is a source document that provides the evidence and data for accounting transactions?

A) Journal

B) Sales invoice

C) Ledger

D) Trial balance

Answer: B

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

15) A business purchased $3,500 of office supplies for cash. Which of the following sets of ledger accounts reflect the posting of this transaction?

A)

B)

C)

D)

Answer: D

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

16) A business renders services to a client and issues a sales invoice. The amount will be collected from the customer at a later time. Which of the following would be true at the time the invoice is issued?

A) Owner's equity will decrease.

B) Total liabilities will increase.

C) Total assets will decrease.

D) Net income will increase.

Answer: D

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

17) Sandra invests $40,000 in her new business by depositing the cash in the business's bank account. Which of the following accounts will be debited?

A) Accounts Receivable

B) Cash

C) Sandra, Capital

D) Accounts Payable

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

18) Sandra invests $40,000 in her new business by depositing the cash in the business's bank account. Which of the following accounts will be credited?

A) Accounts Receivable

B) Cash

C) Sandra, Capital

D) Accounts Payable

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

19) A business purchases equipment for $8,000 cash. Which of the following accounts will be debited?

A) Cash

B) Accounts Payable

C) Sandra, Capital

D) Equipment

Answer: D

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

20) A business purchases equipment for $8,000 cash. Which of the following accounts will be credited?

A) Cash

B) Accounts Payable

C) Sandra, Capital

D) Equipment

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

21) A business makes a cash payment of $12,000 to a supplier. Which of the following accounts will be debited?

A) Cash

B) Accounts Payable

C) Bank

D) Accounts Receivable

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

22) A business makes a cash payment of $12,000 to a creditor. Which of the following accounts will be credited?

A) Cash

B) Accounts payable

C) Bank

D) Accounts receivable

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

23) A business renders services to a customer for $26,000 on account. Which of the following accounts will be debited?

A) Cash

B) Accounts Receivable

C) Service Revenue

D) Bank

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

24) A business renders services to a customer for $26,000 on account. Which of the following accounts will be credited?

A) Cash

B) Accounts Receivable

C) Service Revenue

D) Bank

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

25) A business renders services for $26,000 and collects cash from the customer. Which of the following accounts will be debited?

A) Cash

B) Accounts Receivable

C) Service Revenue

D) Bank

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

26) Beetles Inc. recorded the following journal entry on March 2, 2014:

| Cash | 5,000 | |

| Unearned Revenue | 5,000 |

From the journal entry above, identify the transaction on March 2, 2014.

A) Beetles purchased goods worth $5,000 and signed a one-year note for the same.

B) Beetles sold goods for $5,000 cash.

C) Beetles received $5,000 for services to be performed in a later period.

D) Beetles paid $5,000 for services to be received at a later date.

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

27) A business pays $500 cash for office supplies. Which of the following accounts will be debited?

A) Cash

B) Accounts Payable

C) Office Supplies

D) Utilities Expense

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

28) A business pays $500 cash for office supplies. Which of the following accounts will be credited?

A) Cash

B) Accounts Payable

C) Office Supplies

D) Utilities Expense

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

29) A business buys $500 of Office Supplies on account. Which of the following accounts is debited?

A) Cash

B) Accounts Payable

C) Office Supplies

D) Utilities Expense

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

30) A business buys $500 of Office Supplies on account. Which of the following accounts is credited?

A) Cash

B) Accounts payable

C) Office Supplies

D) Service revenue

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

31) A business makes a cash payment to a supplier on account (for Office Supplies which were purchased earlier.) Which of the following accounts will be debited?

A) Cash

B) Accounts Payable

C) Office Supplies

D) Utilities Expense

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

32) A business makes a cash payment to a supplier on account (for Office Supplies which were purchased earlier.) Which of the following accounts will be credited?

A) Cash

B) Accounts Payable

C) Office Supplies

D) Utilities Expense

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

33) A business collects cash from a customer on settlement of accounts receivable. Which of the following accounts will be debited?

A) Cash

B) Accounts Receivable

C) Service Revenue

D) Accounts Payable

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

34) A business collects cash from a customer on settlement of accounts receivable. Which of the following accounts will be credited?

A) Cash

B) Accounts Receivable

C) Service Revenue

D) Accounts Payable

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

35) A business borrows cash by signing a note payable. Which of the following accounts will be debited?

A) Notes Payable

B) Accounts Payable

C) Bank

D) Cash

Answer: D

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

36) A business borrows cash by signing a note payable. Which of the following accounts will be credited?

A) Notes Payable

B) Accounts Payable

C) Bank

D) Cash

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

37) A business repays the amount borrowed on a note payable by cash. Which of the following accounts will be debited?

A) Cash

B) Bank

C) Notes Payable

D) Notes Receivable

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

38) A business repays the amount borrowed on a note payable by cash. Which of the following accounts will be credited?

A) Accounts Payable

B) Cash

C) Notes Payable

D) Notes Receivable

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

39) A business makes a payment in cash for advertising expense. Which of the following accounts will be debited?

A) Cash

B) Bank

C) Accounts Receivable

D) Advertising Expense

Answer: D

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

40) A business makes a payment in cash for advertising expense. Which of the following accounts will be credited?

A) Notes Payable

B) Accounts receivable

C) Cash

D) Advertising expense

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

41) A business pays cash back to the owner. Which of the following accounts will be debited?

A) Cash

B) Smith, Withdrawals

C) Accounts Payable

D) Smith, Capital

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

42) The owner of a business withdrew cash for personal use. Which of the following accounts will be credited?

A) Smith, Capital

B) Smith, Withdrawals

C) Cash

D) Accounts Payable

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

43) An accounting entry that is characterized by having multiple debits and/or multiple credits is called a ________ entry.

A) balanced

B) posted

C) chart of accounts

D) compound journal

Answer: D

Diff: 2

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

44) A business makes a payment of $1,400 on a note payable, consisting of a $200 interest payment and a $1,200 principal payment. Which of the following journal entries would be recorded?

A) Cash is credited for $1,200; Interest Expense is credited for $200; and Notes Payable is debited for $1,400.

B) Notes Payable is credited for $1,200; Cash is credited for $200; and Interest Expense is debited for $1,400.

C) Cash is credited for $1,400; Notes payable is debited for $1,200; and Interest Expense is debited for $200.

D) Notes Payable is credited for $1,400; Cash is debited for $1,200; and Interest Expense is debited for $200.

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

45) A business purchases equipment by paying $8,000 in cash and issuing a note payable of $12,000. Which of the following occurs?

A) Cash is credited for $8,000; Equipment is credited for $20,000; and Notes Payable is debited for $12,000.

B) Cash is credited for $8,000; Equipment is debited for $20,000; and Notes Payable is credited for $12,000.

C) Cash is debited for $8,000; Equipment is debited for $12,000; and Notes Payable is credited for $20,000.

D) Cash is debited for $8,000; Equipment is credited for $12,000; and Notes Payable is debited for $4,000.

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

46) Which of the following journal entries would be recorded if a business purchased $800 of office supplies on account?

A)

| Accounts payable | 800 | |

| Office Supplies | 800 |

B)

| Office Supplies | 800 | |

| Accounts payable | 800 |

C)

| Office Supplies | 800 | |

| Cash | 800 |

D)

| Cash | 800 | |

| Office Supplies | 800 |

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

47) Which of the following journal entries would be recorded if a business renders service and receives cash of $900 from the customer?

A)

| Service revenue | 900 | |

| Cash | 900 |

B)

| Service revenue | 900 | |

| Accounts payable | 900 |

C)

| Cash | 900 | |

| Service revenue | 900 |

D)

| Service revenue | 900 | |

| Accounts receivable | 900 |

Answer: C

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

48) Which of the following journal entries would be recorded if a business makes a cash payment to a supplier of $750 on account (the business had purchased office supplies on account in the previous month)?

A)

| Cash | 750 | |

| Accounts Payable | 750 |

B)

| Accounts Payable | 750 | |

| Cash | 750 |

C)

| Cash | 750 | |

| Office Supplies | 750 |

D)

| Accounts Payable | 750 | |

| Office Supplies | 750 |

Answer: B

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

49) Which of the following journal entries would be recorded if Christy Jones started a business and deposited cash of $3,000 into the business's bank account?

A)

| Cash | 3,000 | |

| Christy Jones, Capital | 3,000 |

B)

| Accounts Payable | 3,000 | |

| Cash | 3,000 |

C)

| Christy Jones, Capital | 3,000 | |

| Cash | 3,000 |

D)

| Christy Jones, Capital | 3,000 | |

| Accounts Payable | 3,000 |

Answer: A

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

50) The following transactions for the month of March have been journalized and posted to the proper accounts.

Mar. 1 Martinez invested $9,000 cash in his new design services business.

Mar. 2 Paid the first month's rent of $800.

Mar. 3 Purchased equipment by paying $3,000 cash and executing a note payable for $5,000.

Mar. 4 Purchased office supplies for $750 cash.

Mar. 5 Billed a client for $10,000 of design services completed.

Mar. 6 Received $8,000 on account for the services previously recorded.

What is the balance in Cash?

A) $13,250

B) $12,450

C) $15,450

D) $14,000

Answer: B

Explanation: B)

Cash

Mar. 1 9,000 Mar. 2 800

Mar. 6 8,000 Mar. 3 3,000

Mar. 4 750

Balance 12,450

Diff: 3

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

51) Sharon Company reported the following transactions for September, 2015.

A) Sharon started the business with a capital contribution of $25,000 cash. It was credited to Sharon, Capital.

B) The business purchased office equipment for $11,500 for which $2,500 cash was paid and the balance was put on a note payable.

C) Paid insurance expense of $1,800 cash.

D) Paid a utility bill for $900 cash.

E) Paid $2,000 cash for September rent.

F) The business had sales of $12,000 in September. Of these sales, 60% were cash sales, and the balance was credit sales.

G) The business paid $8,000 cash for office furniture.

What are the total liabilities at the end of September, 2015?

A) $8,000

B) $1,800

C) $9,000

D) $11,500

Answer: C

Explanation: C) Liability = Note payable = $11,500 - $2,500 = $9,000

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

52) The following transactions for the month of March have been journalized and posted to the proper accounts.

Mar. 1 Martinez invested $9,000 cash in his new design services business.

Mar. 2 Paid the first month's rent of $800.

Mar. 3 Purchased equipment by paying $3,000 cash and executing a note payable for $5,000.

Mar. 4 Purchased Office Supplies for $750 cash.

Mar. 5 Billed a client for $10,000 of design services completed.

Mar. 6 Received $8,000 on account for the services previously recorded.

What is the balance in Accounts Receivable?

A) $8,000

B) $2,000

C) $5,000

D) $10,000

Answer: B

Explanation: B) Accounts Receivable

Mar. 5 10,000 8,000 Mar. 6

Bal. 2,000

Diff: 3

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

53) The following transactions for the month of March have been journalized and posted to the proper accounts.

Mar. 1 Martinez invested $9,000 cash in his new design services business.

Mar. 2 Paid the first month's rent of $800.

Mar. 3 Purchased equipment by paying $3,000 cash and executing a note payable for $5,000.

Mar. 4 Purchased office supplies for $750 cash.

Mar. 5 Billed a client for $10,000 of design services completed.

Mar. 6 Received $8,000 on account for the services previously recorded.

What is the ending balance in the Service Revenue account?

A) $19,000

B) $9,000

C) $10,000

D) $8,000

Answer: C

Diff: 3

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

54) A business has the following transactions: the business is started by receiving $20,000 from the owner. The business purchases $500 of office supplies on account. The business purchases $2,000 of furniture on account. The business renders services to various clients totaling $10,000 on account. The business pays out $2,000 for salaries expense and $3,000 for Rent Expense. Business pays $500 to supplier for the office supplies purchased earlier. The business collects $3,000 from one of its clients for services rendered earlier in the month. At the end of the month, all journal entries are posted to the ledger. The Accounts Receivable account will appear as:

A)

B)

C)

D)

Answer: D

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

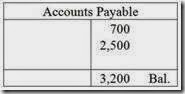

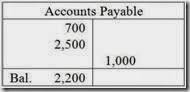

55) A business has the following transactions: The business is started by receiving $25,000 from the owner. The business purchased $700 of office supplies on account and $2,500 of furniture on account. The business rendered services to various clients totaling $10,000 on account. It paid $5,000 as salaries expense and $6,000 as rent expense. It paid $1,000 to a supplier for the office supplies purchased earlier. It collected $3,000 from one of its clients for services rendered earlier in the month. At the end of the month, all journal entries are posted to the ledger. The Accounts Payable account will appear as:

A)

B)

C)

D)

Answer: D

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

56) A business purchased land for $250,000 cash. Provide the journal entry (debits first, credits second.)

Answer:

Land 250,000

Cash 250,000

Purchased land for cash.

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

57) A business renders services to its customer for $50,000 on account. Provide the journal entry (debits first, credits second.)

Answer:

Accounts Receivable 50,000

Service Revenue 50,000

Performed services on account.

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

58) A business paid salaries of $6,000 in cash. Provide the journal entry (debits first, credits second.)

Answer:

Salaries Expense 6,000

Cash 6,000

Paid salaries.

Diff: 2

LO: 2-3

AACSB: Application

AICPA Functional: Measurement

59) A posting reference column is added:

A) while preparing the trial balance using the ledger.

B) when the information is transferred from the journal to the ledger.

C) when the information is transferred from the ledger to the journal.

D) while preparing the balance sheet using the trial balance.

Answer: B

Diff: 1

LO: 2-3

AACSB: Concept

AICPA Functional: Measurement

Learning Objective 2-4

1) The trial balance is also known as the balance sheet.

Answer: FALSE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

2) The trial balance verifies the equality of debits and credits.

Answer: TRUE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

3) A trial balance is the list of only a company's debit accounts along with their account numbers.

Answer: FALSE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

4) A trial balance is a list of all of the accounts of a company with their balances.

Answer: TRUE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

5) In a trial balance, total debits must always equal to total credits.

Answer: TRUE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

6) The trial balance is an internal document used only by employees of the company.

Answer: TRUE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

7) A trial balance summarizes a ledger by listing all the accounts with their balances at a point in time.

Answer: TRUE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

8) Data from a trial balance is used to prepare the three basic financial statements.

Answer: TRUE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

9) The trial balance is one of the three basic financial statements that are issued to external stakeholders of the business.

Answer: FALSE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

10) The trial balance summarizes the balances of assets, liabilities, and equity.

Answer: TRUE

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

11) Which of the following is a financial statement that presents a business's accounting equation?

A) chart of accounts

B) trial balance

C) income statement

D) balance sheet

Answer: D

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

12) Which of the following is used by both internal and external users to the company?

A) chart of accounts

B) trial balance

C) balance sheet

D) costing reports

Answer: C

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

13) Which of the following statements is true of a trial balance?

A) A trial balance has the same format as a balance sheet.

B) A trial balance presents data in debit and credit format.

C) A trial balance shows total amounts of assets, liabilities, but not equity.

D) A trial balance is prepared after the balance sheet.

Answer: B

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

14) A journal entry for a $75 payment for rent expense was posted as a debit to Salaries Expense and a credit to Cash. This error will cause which of the following conditions on the trial balance?

A) The sum of the credits will equal the sum of the debits.

B) The sum of the debits will exceed the sum of the credits by $75.

C) The sum of the debits will exceed the sum of the credits by $150.

D) The sum of the credits will exceed the sum of the debits by $150.

Answer: A

Diff: 2

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

15) A journal entry for a $250 payment to purchase office supplies was erroneously recorded as a debit to Office Supplies for $520 and a credit to Cash for $250. Which of the following statements correctly states the effect of the error on the trial balance?

A) The sum of the credits will exceed the sum of the debits by $270.

B) The sum of the debits will exceed the sum of the credits by $250.

C) The sum of the debits will exceed the sum of the credits by $270.

D) The sum of the debits will exceed the sum of the credits by $520.

Answer: C

Diff: 2

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

16) Which of the following sequences states the order in which a trial balance lists accounts?

A) Equity → Assets → Liabilities

B) Liabilities → Assets → Equity

C) Assets → Equity → Liabilities

D) Assets → Liabilities → Equity

Answer: D

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

17) When is a trial balance usually prepared?

A) after each entry is journalized

B) before the financial statements are prepared

C) after the financial statements are prepared

D) at the beginning of an accounting period

Answer: B

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

18) Which of the following statements is true of a trial balance?

A) A trial balance is the first step in the accounting cycle.

B) A trial balance is also known as a balance sheet.

C) A trial balance is a list of all accounts with their balances.

D) A trial balance is also known as the chart of accounts.

Answer: C

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

19) The last step before preparing financial statements is to:

A) post all entries.

B) record all transactions in the journal.

C) prepare the trial balance.

D) review source documents.

Answer: C

Diff: 1

LO: 2-4

AACSB: Concept

AICPA Functional: Measurement

20) The following are the current month's balances for Toys Galore, before preparing the trial balance.

| Accounts Payable | $8,000 |

| Revenue | 10,000 |

| Cash | 5,000 |

| Expenses | 1,750 |

| Furniture | 12,000 |

| Accounts Receivable | 14,000 |

| Jones, Capital | ??? |

| Notes Payable | 6,50 |

What amount should be shown for Jones, Capital on the trial balance?

A) $16,500

B) $8,250

C) $14,500

D) $31,000

Answer: B

Explanation: B) In a trial balance, the total of debits must match the total of credits. Therefore, the balance of Jones, Capital can be determined by totaling the debit and the credit balances and calculating the balancing amount.

| Debit | Credit | |

| Cash | $5,000 | |

| Accounts receivable | 14,000 | |

| Furniture | 12,000 | |

| Accounts payable | $8,000 | |

| Notes payable | | 6,500 |

| Jones, Capital | ||

| Revenues | 10,000 | |

| Expenses | 1,750 | |

| Total | $32,750 | $24,500 |

Jones, Capital = $32,750 - $24,500 = $8,250

Diff: 2

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

21) The following are the current month's balances for Toys Galore:

| Accounts Payable | $8,000 |

| Revenue | 10,000 |

| Cash | 5,000 |

| Expenses | 1,750 |

| Furniture | 12,000 |

| Accounts Receivable | 14,000 |

| Jones, Capital | 8,250 |

| Notes Payable | 6,500 |

Calculate the total amount of credits for the trial balance.

A) $24,500

B) $22,750

C) $24,750

D) $32,750

Answer: D

Explanation: D)

Accounts Payable $ 8,000

Revenue 10,000

Jones, Capital 8,250

Notes Payable 6,500

Total credit amounts $32,750

Diff: 2

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

22) The following are the current month's balances for Toys Galore:

| Accounts Payable | $8,000 |

| Revenue | 10,000 |

| Cash | 5,000 |

| Expenses | 1,750 |

| Furniture | 12,000 |

| Accounts Receivable | 14,000 |

| Jones, Capital | 8,250 |

| Notes Payable | 6,500 |

What is the total amount of debits for the trial balance?

A) $26,000

B) $27,750

C) $31,000

D) $32,750

Answer: D

Explanation: D)

Cash $ 5,000

Expenses 1,750

Furniture 12,000

Accounts Receivable 14,000

Total assets $32,750

Diff: 2

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

23) The following are the current month's balances for Toys Galore:

| Accounts Payable | $8,000 |

| Revenue | 10,000 |

| Cash | 5,000 |

| Expenses | 1,750 |

| Furniture | 12,000 |

| Accounts Receivable | 14,000 |

| Jones, Capital | 8,250 |

| Notes Payable | 6,500 |

What is the net income for Toys Galore for the current month?

A) $10,000

B) $8,250

C) $11,750

D) $15,000

Answer: B

Explanation: B)

Revenue $10,000

Expenses (1,750)

Net Income $ 8,250

Diff: 2

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

24) Which of the following accounts has a normal debit balance?

A) Revenue

B) Notes Payable

C) Cash

D) Accounts Payable

Answer: C

Diff: 1

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

25) The following transactions have been journalized and posted to the proper accounts. Prepare a trial balance using the following details:

a. Edward Wilson invested $15,000 cash in his new landscaping business.

b. Paid the first month's rent with $800 cash.

c. Purchased equipment by paying $4,000 cash and executing a note payable for $4,000.

d. Purchased office supplies for $200 cash.

e. Billed clients for a total of $7,000 for design services rendered.

f. Received $1,000 cash from clients for services rendered above.

Answer:

Account Title Debit Credit

Cash $11,000

Accounts Receivable 6,000

Office Supplies 200

Equipment 8,000

Notes Payable $4,000

Wilson, Capital 15,000

Service revenue 7,000

Rent expense 800 ______

Total $26,000 $26,000

Note:

Cash balance is calculated as:

Owner contribution $15,000

Rent paid (800)

Equipment paid for by cash (4,000)

Office supplies purchased (200)

Service Revenue from clients 1,000

Cash balance $11,000

Explanation:

Diff: 3

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

26) Carol Instruments sells musical instruments. On December 31, 2015, after its first month of business, Carol Instruments had the following balances in its accounts, listed alphabetically.

| Accounts Receivable | $5,000 |

| Accounts Payable | 15,000 |

| Advertising Expense | 2,000 |

| Building | 16,500 |

| Cash | ??? |

| Carol, Capital | 50,000 |

| Carol, Withdrawals | 1,200 |

| Equipment | 2,000 |

| Land | 70,000 |

| Notes Payable | 60,000 |

| Salaries Expense | 4,000 |

| Service Revenue | 72,000 |

| Office Supplies | 3,400 |

| Utilities Expense | 4,100 |

Determine the balance in the cash account and prepare the trial balance.

Answer: In the given problem, the Cash balance is the difference between the debit and credit columns of the Trial Balance.

Carol Instruments

Trial Balance

December 31, 2015

Account Title Debit Credit

Cash

Accounts Receivable $5,000

Office Supplies 3,400

Equipment 2,000

Building 16,500

Land 70,000

Accounts Payable $15,000

Notes Payable 60,000

Carol, Capital 50,000

Carol, Withdrawals 1,200

Service Revenue 72,000

Utilities Expense 4,100

Salaries Expense 4,000

Advertising Expense 2,000

Total $108,200 $197,000

Cash balance = $197,000 - $108,200 = $88,800

Explanation:

Diff: 3

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

27) At the end of a month, a business shows the following balances in its ledger.

Use this data to prepare a trial balance.

Answer: Trial Balance

Account Title Debit Credit

Cash $5,000

Accounts Receivable 1,200

Office Supplies 200

Land 20,000

Accounts Payable $1,300

Smith, Capital 1,000

Service Revenue 35,500

Rent Expense 4,500

Salaries Expense 6,000

Utility Expense 900 ______

Total $37,800 $37,800

Explanation:

Diff: 1

LO: 2-4

AACSB: Application

AICPA Functional: Measurement

Learning Objective 2-5

1) The debt ratio shows the proportion of assets financed with debt.

Answer: TRUE

Diff: 1

LO: 2-5

AACSB: Concept

AICPA Functional: Measurement

2) Grace Company has a debt ratio of 25%; this means that 75% of the assets are financed by creditors of the corporation.

Answer: FALSE

Diff: 1

LO: 2-5

AACSB: Application

AICPA Functional: Measurement

3) The higher the debt ratio, the lower the risk.

Answer: FALSE

Diff: 1

LO: 2-5

AACSB: Concept

AICPA Functional: Measurement

4) Which of the following is the correct formula to calculate the debt ratio?

A) Debt ratio = Total liabilities × Total assets

B) Debt ratio = Total liabilities + Total assets

C) Debt ratio = Total liabilities - Total assets

D) Debt ratio = Total liabilities ÷ Total assets

Answer: D

Diff: 1

LO: 2-5

AACSB: Concept

AICPA Functional: Measurement

5) The percentage of assets that are financed with liabilities can be calculated using the:

A) accounting equation.

B) debt ratio.

C) journal.

D) ledger.

Answer: B

Diff: 1

LO: 2-5

AACSB: Concept

AICPA Functional: Measurement

6) The ability of a company to repay its liabilities can be determined from its:

A) bankers.

B) creditors.

C) debt ratio.

D) journal.

Answer: C

Diff: 1

LO: 2-5

AACSB: Concept

AICPA Functional: Measurement

7) Mitchell Florists reported assets of $1,000 and equity of $350. What is Mitchell's debt ratio?

A) 65%

B) 35%

C) 100%

D) 70%

Answer: A

Diff: 1

LO: 2-5

AACSB: Application

AICPA Functional: Measurement

8) Mitchell Florists had the following total assets, liabilities, and equity as of December 31.

| Assets | $450,000 |

| Liabilities | 135,000 |

| Equity | 315,000 |

What is Mitchell's debt ratio as of December 31?

A) 30%

B) 70%

C) 100%

D) 43%

Answer: A

Diff: 1

LO: 2-5

AACSB: Application

AICPA Functional: Measurement

9) Which of the following factors is assessed using the debt ratio?

A) expenses

B) revenues

C) risk

D) income

Answer: C

Diff: 1

LO: 2-5

AACSB: Concept

AICPA Functional: Measurement

10) Calculate the debt ratio using the following trial balance of Carol Instruments as of December 31, 2015.

Carol Instruments

Trial Balance

December 31, 2015

Account Title Debit Credit

Cash 88,800

Accounts Receivable $ 5,000

Office Supplies 3,400

Equipment 2,000

Building 16,500

Land 70,000

Accounts Payable $15,000

Notes Payable 60,000

Carol, Capital 50,000

Carol, Withdrawals 1,200

Service Revenue 72,000

Utilities Expense 4,100

Salaries Expense 4,000

Advertising Expense 2,000 _______

Total $197,000 $197,000

Answer:

Accounts Payable $15,000

Notes Payable 60,000

Total Liabilities $75,000

Accounts Receivable $ 5,000

Building 16,500

Cash 88,800

Equipment 2,000

Land 70,000

Office Supplies 3,400

Total assets $185,700

Debt ratio ꞊ Total liabilities ÷ Total assets

Debt ratio = $75,000 ÷ $185,700 = 0.40 or 40%

Diff: 3

LO: 2-5

AACSB: Application

AICPA Functional: Measurement

Chapter 2

Recording Business Transactions

Review Questions

1. The three categories of the accounting equation are assets, liabilities, and equity. Assets include Cash, Accounts Receivable, Notes Receivable, Prepaid Expenses, Land, Building, Equipment, Furniture, and Fixtures. Liabilities include Accounts Payable, Notes Payable, Accrued Liability, and Unearned Revenue. Equity includes Owner’s Capital, Owner’s Withdrawals, Revenue, and Expenses.

2. Companies need a way to organize their accounts so they use a chart of accounts. Accounts starting with 1 are usually Assets, 2 – Liabilities, 3 – Equity, 4 – Revenues, and 5 – Expenses. The second and third digits in account number indicate where the account fits within the category.

3. A chart of accounts and a ledger are similar in that they both list the account names and account numbers of the business. A ledger, though, provides more detail. It includes the increases and decreases of each account for a specific period and the balance of each account at a specific point in time.

4. With a double-entry you need to record the dual effects of each transaction. Every transaction affects at least two accounts.

5. A T-account is a shortened form of each account in the ledger. The debit is on the left side, credit on the right side, and the account name is shown on top.

6. Debits are increases for assets, owner’s withdrawals, and expenses. Debits are decreases for liabilities, owner’s capital, and revenue.

7. Credits are increases for liabilities, owner’s capital, and revenue. Credits are decreases for assets, owner’s withdrawal, and expenses.

8. Assets, owner’s withdrawal, and expenses have a normal debit balance. Liabilities, owner’s capital, and revenue have a normal credit balance.

9. Source documents provide the evidence and data for accounting transactions. Examples of source documents a business would have are: bank deposit slips, purchase invoices, bank checks, and sales invoices

10. Transactions are first recorded in a journal, which is the record of transactions in date order.

11. Step 1: Identify the accounts and the account type. You need this information before you can complete the next step. Step 2: Decide if each account increases or decreases using the rules of debits and credits. Reviewing the rules of debits and credits, we use the accounting equation to help determine debits and credits for each account. Step 3: Record transactions in the journal using journal entries. Step 4: Post the journal entry to the ledger. When journal entries are posted from the journal to the ledger, the dollar amount is transferred from the debit and credit columns to the specific accounts in the ledger. The date on the journal entry should also be transferred to the accounts in the ledger. Step 5: Determine whether the accounting equation is in balance. After each entry the accounting equation should always be in balance.

12. Part 1: Date of the transaction. Part 2: Debit account name and dollar amount. Part 3: Credit account name and dollar amount. The credit account name is indented. Part 4: Brief explanation.

13. When transactions are posted from the journal to the ledger, the dollar amount is transferred from the debit and credit columns to the specific accounts in the ledger. The date of the journal entry is also transferred to the accounts in the ledger. The posting reference columns in the journal and ledger are also completed. In a computerized system, this step is completed automatically when the transaction is recorded in the journal.

14. The trial balance is used to prove the equality of total debits and total credits of all accounts in the ledger; it is also used to prepare the financial statements.

15. A trial balance verifies the equality of total debits and total credits of all accounts on the trial balance and is an internal document used only by employees of the company. The balance sheet, on the other hand, presents the business’s accounting equation and is a financial statement that can be used by both internal and external users.

16. If total debits equal total credits on the trial balance, it does not mean that the trial balance is error-free. An incorrect amount could have been used, an entry could have been completely missed, or the wrong account title could have been debited or credited .

17. The debt ratio is calculated by dividing total liabilities by total assets and shows the proportion of assets financed with debt. It can be used to evaluate a business’s ability to pay its debts.

Short Exercises

S2-1

| a. Notes Receivable (A) | f. Taxes Payable (L) |

| b. Nations, Capital (E) | g. Rent Expense (E) |

| c. Prepaid Insurance (A) | h. Furniture (A) |

| d. Notes Payable (L) | i. Nations, Withdrawals (E) |

| e. Rent Revenue (E) | j. Unearned Revenue (L) |

S2-2

| a. Increase to Accounts Receivable (DR) | f. Decrease to Prepaid Rent (CR) |

| b. Decrease to Unearned Revenue (DR) | g. Increase to Perez, Capital (CR) |

| c. Decrease to Cash (CR) | h. Increase to Notes Receivable (DR) |

| d. Increase to Interest Expense (DR) | i. Decrease to Accounts Payable (DR) |

| e. Increase to Salaries Payable (CR) | j. Increase to Interest Revenue (CR) |

S2-3

| a. Notes Payable (CR) | f. Harris, Capital (CR) |

| b. Harris, Withdrawals (DR) | g. Utilities Expense (DR) |

| c. Service Revenue (CR) | h. Office Supplies (DR) |

| d. Land (DR) | i. Advertising Expense (DR) |

| e. Unearned Revenue (CR) | j. Interest Payable (CR) |

S2-4

| Date | Accounts and Explanation | Debit | Credit |

| Jan. 1 | Cash | 29,000 | |

| Brown, Capital | 29,000 | ||

| Received cash from Brown in exchange for capital. | |||

| 2 | Medical Supplies | 14,000 | |

| Accounts Payable | 14,000 | ||

| Purchased medical supplies on account. | |||

| 4 | Cash | 1,400 | |

| Service Revenue | 1,400 | ||

| Performed services for patients. | |||

| 12 | Rent Expense | 2,600 | |

| Cash | 2,600 | ||

| Paid rent with cash. | |||

| 15 | Accounts Receivable | 8,000 | |

| Service Revenue | 8,000 | ||

| Performed services for patients on account. | |||

| |

S2-5

| Date | Accounts and Explanation | Debit | Credit |

| Jan. 22 | Accounts Receivable | 8,000 | |

| Service Revenue | 8,000 | ||

| Performed services for customers on account. | |||

| | |||

| 30 | Cash | 7,000 | |

| Accounts Receivable | 7,000 | ||

| Received cash on account from customers. | |||

| | |||

| 31 | Utilities Expense | 180 | |

| Utilities Payable | 180 | ||

| Received a utility bill due in February. | |||

| | |||

| 31 | Salaries Expense | 2,000 | |

| Cash | 2,000 | ||

| Paid monthly salary to salesman. | |||

| | |||

| 31 | Cash | 1,500 | |

| Unearned Revenue | 1,500 | ||

| Received 3 months consulting services in advance. | |||

| | |||

| 31 | Hansen, Withdrawals | 1,000 | |

| Cash | 1,000 | ||

| Owner withdrawal of cash. | |||

| |

S2-6

| Accounts Payable | |

| May 2 6,000 | 14,000 May 1 |

| May 22 12,000 | 1,000 May 5 |

| 7,000 May 15 | |

| 500 May 23 | |

| | 4,500 Bal. |

S2-7

Requirement 1

| Date | Accounts and Explanation | Debit | Credit |

| Mar. 15 | Office Supplies | 3,400 | |

| Accounts Payable | 3,400 | ||

| Purchased office supplies on account. | |||

| | |||

| 28 | Accounts Payable | 1,200 | |

| Cash | 1,200 | ||

| Paid cash on account. | |||

| |

Requirement 2

| Cash | Accounts Payable | |||||||

| Bal. | 14,000 | 1,200 | Mar. 28 | Mar. 28 | 1,200 | 3,400 | Mar. 15 | |

| Bal. | 12,800 | 2,200 | Bal. | |||||

| Office Supplies | ||||||||

| Mar. 15 | 3,400 | |||||||

| Bal. | 3,400 | |||||||

S2-8

| OAKLAND FLOOR COVERINGS | ||

| Trial Balance | ||

| December 31, 2014 | ||

| Account Title | Balance | |

| Debit | Credit | |

| Cash | $ 8,000 | |

| Accounts Receivable | 4,000 | |

| Equipment | 45,000 | |

| Accounts Payable | $ 2,000 | |

| Salaries Payable | 12,000 | |

| Interest Payable | 6,000 | |

| Oakland, Capital | 22,000 | |

| Oakland, Withdrawals | 1,800 | |

| Service Revenue | 34,000 | |

| Rent Expense | 14,000 | |

| Salaries Expense | 2,000 | |

| Utilities Expense | 1,200 | |

| Total | $ 76,000 | $ 76,000 |

| | |

S2-9

Debt ratio = Total liabilities / Total assets = $69,000 / $230,000 = 0.30 = 30%

Exercises

E2-10

| 1. g |

| 2. a |

| 3. e |

| 4. d |

| 5. j |

| 6. i |

| 7. f |

| 8. b |

| 9. h |

| 10. c |

E2-11

| Assets | Equity |

| 100 – Cash | 300 – Richard, Capital |

| 110 – Automotive Supplies | 310 – Richard, Withdrawals |

| 120 – Equipment | |

| Revenues | |

| Liabilities | 400 – Service Revenue |

| 200 – Accounts Payable | |

| 210 – Unearned Revenue | Expenses |

| 500 – Utilities Expense | |

| 510 – Advertising Expense | |

E2-12

| | | Requirement 1 | Requirement 2 | Requirement 3 |

| | Account Name | Type of Account | Increase with Debit/Credit | Normal Balance Debit/Credit |

| a. | Interest Revenue | E | CR | CR |

| b. | Accounts Payable | L | CR | CR |

| c. | Chapman, Capital | E | CR | CR |

| d. | Office Supplies | A | DR | DR |

| e. | Advertising Expense | E | DR | DR |

| f. | Unearned Revenue | L | CR | CR |

| g. | Prepaid Rent | A | DR | DR |

| h. | Utilities Expense | E | DR | DR |

| i. | Chapman, Withdrawals | E | DR | DR |

| j. | Service Revenue | E | CR | CR |

E2-13

| (a) Assets | = | Liabilities | + | (b) Equity | ||||||||||||

| Assets | = | (c) Liabilities | + | Owner's Capital | – | (d) Owner's Withdrawals | + | Revenues | – | Expenses | ||||||

| (e) Incr. | Decr. | Decr. | (f) Incr. | (g) Decr. | (h) Incr. | (i) Incr. | (j) Decr. | (k) Decr. | (l) Incr. | Incr. | (m) Decr. | |||||

| Debit | (n) Credit | (o) Debit | Credit | (p) Debit | Credit | (q) Debit | Credit | Debit | Credit | (r) Debit | Credit |

(a) Assets

(b) Equity

(c) Liabilities

(d) Owner's Withdrawals

(e) Incr.

(f) Incr.

(g) Decr.

(h) Incr.

(i) Incr.

(j) Decr.

(k) Decr.

(l) Incr.

(m)Decr.

(n) Credit

(o) Debit

(p) Debit

(q) Debit

(r) Debit

E2-14

a. Bank deposit slip

b. Purchase invoice

c. Sales invoice

E2-15

a. Purchased equipment with cash.

b. The owner, Fernandez, withdrew cash from the business.

c. Paid wages owed to employees, previously recorded.

d. The owner, Fernandez, gave equipment to the business in exchange for capital.

e. Received cash from customer for work to be completed in the future.

f. Paid for advertising with cash.

g. Performed services that were paid by the customer.

E2-16

| Date | Accounts and Explanation | Debit | Credit |

| Jul. 2 | Cash | 10,000 | |

| London, Capital | 10,000 | ||

| Owner contributed cash to business in exchange for capital. | |||

| | |||

| 4 | Utilities Expense | 400 | |

| Cash | 400 | ||

| Paid utility expense. | |||

| | |||

| 5 | Equipment | 2,100 | |

| Accounts Payable | 2,100 | ||

| Purchased equipment on account. | |||

| | |||

| 10 | Accounts Receivable | 2,000 | |

| Service Revenue | 2,000 | ||

| Performed services for client on account. | |||

| | |||

| 12 | Cash | 7,000 | |

| Notes Payable | 7,000 | ||

| Borrowed cash by signing note. | |||

| | |||

| 19 | London, Withdrawals | 500 | |

| Cash | 500 | ||

| Owner withdrew money from the business. | |||

| |

E2-16, cont.

| 21 | Office Supplies | 800 | |

| Cash | 800 | ||

| Purchased office supplies with cash. | |||

| | |||

| 27 | Accounts Payable | 2,100 | |

| Cash | 2,100 | ||

| Paid cash on account. | |||

| |

E2-17

Requirements 1, 2, and 3

| Cash | Accounts Payable | |||

| Jul. 2 10,000 | 400 Jul. 4 | Jul. 27 2,100 | 2,100 Jul. 5 | |

| Jul. 12 7,000 | 500 Jul. 19 | 0 Balance | ||

| 800 Jul. 21 | ||||

| 2,100 Jul. 27 | ||||

| Balance 13,200 | ||||

| Accounts Receivable | Notes Payable | |||

| Jul. 10 2,000 | 7,000 Jul. 12 | |||

| Balance 2,000 | 7,000 Balance | |||

| Office Supplies | London, Capital | |||

| Jul. 21 800 | 10,000 Jul. 2 | |||

| Balance 800 | 10,000 Balance | |||

| Equipment | London, Withdrawals | |||

| Jul. 5 2,100 | Jul. 19 500 | |||

| Balance 2,100 | Balance 500 | |||

| Service Revenue | ||||

| 2,000 Jul. 10 | ||||

| 2,000 Balance | ||||

| Utilities Expense | ||||

| Jul. 4 400 | ||||

| Balance 400 | ||||

| Date | Accounts and Explanation | Post. Ref. | Debit | Credit |

| May 1 | Cash | 75,000 | ||

| Ward, Capital. | 75,000 | |||

| Owner contributed cash to business in exchange for capital. | ||||

| | ||||

| 2 | Office Supplies | 500 | ||

| Accounts Payable | 500 | |||

| Purchased office supplies on account. | ||||

| | ||||

| 4 | Building | 45,000 | ||

| Land | 8,000 | |||

| Cash | 53,000 | |||

| Purchased building and land for cash. | ||||

| | ||||

| 6 | Cash | 2,600 | ||

| Service Revenue | 2,600 | |||

| Performed services for customers for cash. | ||||

| | ||||

| 9 | Accounts Payable | 400 | ||

| Cash | 400 | |||

| Paid cash on account. | ||||

| | ||||

| 17 | Accounts Receivable | 2,500 | ||

| Service Revenue | 2,500 | |||

| Performed services for customers on account. | ||||

| | ||||

| 19 | Rent Expense | 900 | ||

| Cash | 900 | |||

| Paid rent for the month. | ||||

| | ||||

| 20 | Cash | 1,200 | ||

| Unearned Revenue | 1,200 | |||

| Received cash from customers for services to be performed next month. | ||||

| | ||||

| 21 | Prepaid Advertising | 500 | ||

| Cash | 500 | |||

| Paid for next month’s advertising. | ||||

| |

E2-18, cont.

| 23 | Cash | 1,900 | ||

| Accounts Receivable | 1,900 | |||

| Received cash on account from customer. | ||||

| 31 | Salaries Expense | 1,100 | ||

| Cash | 1,100 | |||

| Paid salaries. | ||||

| |

E2-19

Requirement 2

| Date | Accounts and Explanation | Post. Ref. | Debit | Credit |

| May 1 | Cash | 110 | 75,000 | |

| Ward, Capital | 310 | 75,000 | ||

| Owner contributed cash to business in exchange for capital. | ||||

| | ||||

| 2 | Office Supplies | 130 | 500 | |

| Accounts Payable | 210 | 500 | ||

| Purchased office supplies on account. | ||||

| | ||||

| 4 | Building | 150 | 45,000 | |

| Land | 160 | 8,000 | ||

| Cash | 110 | 53,000 | ||

| Purchased building and land for cash. | ||||

| | ||||

| 6 | Cash | 110 | 2,600 | |

| Service Revenue | 410 | 2,600 | ||

| Performed services for customers for cash. | ||||

| | ||||

| 9 | Accounts Payable | 210 | 400 | |

| Cash | 110 | 400 | ||

| Paid cash on account. | ||||

| | ||||

| 17 | Accounts Receivable | 120 | 2,500 | |

| Service Revenue | 410 | 2,500 | ||

| Performed services for customers on account. | ||||

| |

E2-19, cont.

| 19 | Rent Expense | 510 | 900 | |

| Cash | 110 | 900 | ||

| Paid rent for the month. | ||||

| | ||||

| 20 | Cash | 110 | 1,200 | |

| Unearned Revenue | 220 | 1,200 | ||

| Received cash from customers for services to be performed next month. | ||||

| | ||||

| 21 | Prepaid Advertising | 140 | 500 | |

| Cash | 110 | 500 | ||

| Paid for next month’s advertising. | ||||

| | ||||

| 23 | Cash | 110 | 1,900 | |

| Accounts Receivable | 120 | 1,900 | ||

| Received cash on account from customer. | ||||

| | ||||

| 31 | Salaries Expense | 520 | 1,100 | |

| Cash | 110 | 1,100 | ||

| Paid salaries. | ||||

| |

Requirements 1 and 2

| CASH | Account No. 110 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 1 | J10 | 75,000 | 75,000 | |||

| May 4 | J10 | 53,000 | 22,000 | |||

| May 6 | J10 | 2,600 | 24,600 | |||

| May 9 | J10 | 400 | 24,200 | |||

| May 19 | J10 | 900 | 23,300 | |||

| May 20 | J10 | 1,200 | 24,500 | |||

| May 21 | J10 | 500 | 24,000 | |||

| May 23 | J10 | 1,900 | 25,900 | |||

| May 31 | J10 | 1,100 | 24,800 |

| ACCOUNTS RECEIVABLE | Account No. 120 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 17 | J10 | 2,500 | 2,500 | |||

| May 23 | J10 | 1,900 | 600 |

E2-19, cont.

| OFFICE SUPPLIES | Account No. 130 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 2 | J10 | 500 | 500 |

| PREPAID ADVERTISING | Account No. 140 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 21 | J10 | 500 | 500 |

| BUILDING | Account No. 150 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 4 | J10 | 45,000 | 45,000 |

| LAND | Account No. 160 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 4 | J10 | 8,000 | 8,000 |

| ACCOUNTS PAYABLE | Account No. 210 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 2 | J10 | 500 | 500 | |||

| May 9 | J10 | 400 | 100 |

| UNEARNED REVENUE | Account No. 220 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 20 | J10 | 1,200 | 1,200 |

| WARD, CAPITAL | Account No. 310 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 1 | J10 | 75,000 | 75,000 |

E2-19, cont.

| SERVICE REVENUE | Account No. 410 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 6 | J10 | 2,600 | 2,600 | |||

| May 17 | J10 | 2,500 | 5,100 |

| RENT EXPENSE | Account No. 510 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 19 | J10 | 900 | 900 |

| SALARIES EXPENSE | Account No. 520 | |||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| May 31 | J10 | 1,100 | 1,100 |

E2-20

| 1. The business received cash of $370,000 from the owner and gave capital to Cougliato, the owner. |

| 2. Paid $360,000 cash for a building. |

| 3. Borrowed $260,000 cash, signing a notes payable. |

| 4. Purchased office supplies on account, $1,500. |

| 5. Paid $1,200 on accounts payable. |

| 6. Paid property tax expense, $1,500. |

| 7. Paid rent $1,400 and salaries $2,500. |

| 8. The owner, Cougliato withdrew $7,000 cash from the business. |

| 9. Performed services for customers and received cash, $21,000. |

E2-21

| Date | Accounts and Explanation | Posting Ref. | Debit | Credit |

| 1. | Cash | 53,000 | ||

| Adams, Capital | 53,000 | |||

| Owner contributed cash to business in exchange for capital. | ||||

| | ||||

| 2. | Office Supplies | 700 | ||

| Accounts Payable | 700 | |||

| Purchased office supplies on account. | ||||

| | ||||

| 3. | Building | 40,000 | ||

| Cash | 40,000 | |||

| Purchased building for cash. | ||||

| | ||||

| 4. | Cash | 50,000 | ||

| Notes Payable | 50,000 | |||

| Borrowed money signing a note payable. | ||||

| | ||||

| 5. | Equipment | 4,700 | ||

| Cash | 4,700 | |||

| Purchased equipment for cash. | ||||

| |

E2-22

| ATKINS MOVING COMPANY | ||

| Trial Balance | ||

| August 31, 2015 | ||

| Account Title | Balance | |

| Debit | Credit | |

| Cash | $ 4,000 | |

| Accounts Receivable | 8,800 | |

| Office Supplies | 300 | |

| Trucks | 132,000 | |

| Building | 48,000 | |

| Accounts Payable | $ 4,000 | |

| Notes Payable | 54,000 | |

| Atkins, Capital | 72,000 | |

| Atkins, Withdrawals | 5,400 | |

| Service Revenue | 80,000 | |

| Salaries Expense | 7,000 | |

| Fuel Expense | 3,000 | |

| Insurance Expense | 600 | |

| Utilities Expense | 500 | |

| Advertising Expense | 400 | |

| Total | $ 210,000 | $ 210,000 |

| | |

E2-23

| MCDONALD FARM EQUIPMENT REPAIR | ||

| Trial Balance | ||

| May 31, 2015 | ||

| Account Title | Balance | |

| Debit | Credit | |

| Cash | $ 2,400 | |

| Accounts Receivable | 3,700 | |

| Equipment | 14,000 | |

| Building | 35,000 | |

| Land | 10,000 | |

| Accounts Payable | $ 4,000 | |

| Notes Payable | 30,000 | |

| McDonald, Capital | 34,000 | |

| McDonald, Withdrawals | 1,800 | |

| Service Revenue | 6,500 | |

| Salaries Expense | 6,500 | |

| Property Tax Expense | 800 | |

| Advertising Expense | 300 | |

| Total | $ 74,500 | $ 74,500 |

| | |

E2-24

Requirement 2

| Date | Accounts and Explanation | Post Ref. | Debit | Credit |