Cecchetti - money, banking, and financial markets - 4e, test bank 007802174x

Money, Banking and Financial Markets by Stephen Cecchetti and Kermit Schoenholtz- 4e, test bank 007802174x

ch2 Key

| 1. | Which of the following would not be considered a characteristic of money?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #1 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 2. | A society without any money:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #2 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 3. | The use of money makes us more efficient because:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #3 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 4. | The unit of account characteristic of money:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #4 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 5. | Without the use of money, workers in an economy would:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #5 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 6. | As an economy produces more different types of goods:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Evaluate Cecchetti - Chapter 02 #6 Difficulty: 3 Hard Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 7. | The store of value characteristic of money refers to the fact that:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #7 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 8. | Which best describes money as a means of payment?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #8 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 9. | Compare two economies: a barter economy versus an economy that uses money. In order to exchange goods and services:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #9 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 10. | In a barter system people:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #10 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 11. | How many prices would a trader of a particular good need to know in a barter economy with 5 goods?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #11 Difficulty: 3 Hard Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 12. | How many prices would a trader of a particular good need to know in a barter economy with 20 goods?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #12 Difficulty: 3 Hard Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 13. | In a barter economy with "n" number of goods there will always be:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #13 Difficulty: 3 Hard Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 14. | The high transaction costs associated with a barter system refers to the:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #14 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 15. | Suppose that in a barter economy Tom bakes bread and Hans produces chocolates. Tom wants chocolates but Hans doesn't like bread, so Hans is unwilling to trade with Tom. Tom's problem is an example of which problem associated with a barter system?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #15 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 16. | Specialization usually increases the output of a country; however effective specialization requires:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #16 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 17. | Which of the following is not an example of bartering?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #17 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 18. | Money eliminates the need for:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #18 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 19. | Money as a means of payment refers to:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #19 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 20. | While money is an asset not all assets are money because:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #20 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 21. | An advantage that money has over other assets is that it:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #21 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 22. | An individual who stores wealth in art rather than money will find that he/she:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #22 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 23. | Which of the following statements is most correct?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #23 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 24. | Which of the following is incorrect?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #24 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 25. | Which of the following statements is not true?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #25 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 26. | Gold would be a superior commodity money compared to wheat because:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #26 Difficulty: 3 Hard Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 27. | The fact that U.S. currency is legal tender means:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #27 Difficulty: 1 Easy Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 28. | In comparing money to a U.S. Treasury bond held by an individual, we can say:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #28 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 29. | In comparing money to a U.S. Treasury bond held by an individual, we can say:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #29 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 30. | In comparing money to a share of Microsoft stock held by an individual, we can say:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #30 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 31. | Comparing checks and currency, we can say:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #31 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 32. | When the Continental Congress issued currency to finance the Revolutionary War, the Continental Congress:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #32 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 33. | During the Civil War, the North issued currency, known as "greenbacks". Which of the following is true of "greenbacks"?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #33 Difficulty: 3 Hard Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 34. | Most of the non-cash retail payments made each year in the United States are made by:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #34 Difficulty: 1 Easy Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 35. | All of the following are true about electronic funds transfers except:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #35 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 36. | Carlos pays his cable bill using his bank's internet banking web site to withdraw funds from his checking account. This transaction is a(n):

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #36 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 37. | As a result of "Check 21—The Check Clearing for the 21st Century Act":

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #37 Difficulty: 1 Easy Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 38. | The value of fiat money:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #38 Difficulty: 1 Easy Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 39. | Which of the following could not be commodity money?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #39 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 40. | U.S. currency is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #40 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 41. | One major difference between a debit card and a credit card is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #41 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 42. | One major difference between a debit and credit card is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #42 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 43. | To say an asset is liquid implies that:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #43 Difficulty: 1 Easy Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 44. | One advantage of using checks over a debit card is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #44 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 45. | Checks and currency function similarly, however:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #45 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 46. | Money aggregates can best be defined as a set of measures of the amount of:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #46 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 47. | The money aggregate M1 includes each of the following, except:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #47 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 48. | The amount of currency in the hands of the public is approximately what percentage of M1?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #48 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 49. | The money aggregate M2 includes:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #49 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 50. | The most commonly quoted monetary aggregate is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #50 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 51. | An automobile is an asset, but it is not liquid because:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #51 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 52. | Which of the following lists correctly orders assets from most liquid to least liquid?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Create Cecchetti - Chapter 02 #52 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 53. | Which of the following assets is the most liquid?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #53 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 54. | Considering the roughly $1.2 trillion in U.S. currency held by the public:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #54 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 55. | Ava buys a $2,000 computer using a paper check. At which step does $2,000 get recorded in M1?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Analyze Cecchetti - Chapter 02 #55 Difficulty: 3 Hard Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 56. | Sophia receives a $400 gift card for her campus bookstore from her parents. Which of the following is true regarding the $400 gift card?

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #56 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 57. | Gross Domestic Product in the U.S. is roughly:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #57 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 58. | M1 is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #58 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 59. | M1 is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #59 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 60. | M1 has decreased in its usefulness in understanding inflation due to:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #60 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 61. | The introduction of money market substitutes for basic checking accounts was fueled partially by the:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #61 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Money and How We Use It |

| 62. | A cross-country analysis of money growth supports the conclusion that:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #62 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 63. | A cross-country analysis of money growth shows that the growth rate in the money supply was:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #63 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 64. | The Consumer Price Index (CPI) is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #64 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 65. | The Consumer Price Index (CPI):

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #65 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 66. | The Consumer Price Index (CPI):

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #66 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 67. | Economists study the link between money and inflation because:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #67 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 68. | Inflation refers to growth in the economy's:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #68 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 69. | When the price level increases, the purchasing power of money:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Analyze Cecchetti - Chapter 02 #69 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 70. | The purchasing power of money:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #70 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 71. | Which of the following statements is incorrect?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Analyze Cecchetti - Chapter 02 #71 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 72. | Which of the following statements is correct?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Analyze Cecchetti - Chapter 02 #72 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 73. | The U.S. Treasury estimates that the fraction of U.S. currency held outside the United States is:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Remember Cecchetti - Chapter 02 #73 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 74. | In countries with low inflation:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #74 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 75. | Sue uses a credit card to purchase a new pair of jeans. Sue is:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #75 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Money and How We Use It |

| 76. | The value of money as a means of payment:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Understand Cecchetti - Chapter 02 #76 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 77. | The primary concern of current critics of fiat money is that:

|

| AACSB: Reflective Thinking Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #77 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 78. | Current critics of fiat money are urging governments to do what?

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #78 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 79. | A policy is time consistent when:

|

| AACSB: Analytic Accessibility: Keyboard Navigation Blooms: Apply Cecchetti - Chapter 02 #79 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 80. | Consider the following: there are two countries, A and B. Each country has the same resources, and produces the same goods. The residents of country A use money; the residents of country B rely on bartering of goods. Will each country produce the same quantity of output? Explain. No, the residents of Country B will definitely spend more of their time transacting, trying to create a double coincidence of wants, and may have to rely on multiple trades to do so. They will also likely specialize less, reducing the gains to the country from specialization. In country A the residents will be able to transact immediately using money, and will also be able to specialize in what they do well creating a more efficient economy. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #80 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 81. | Consider an island where people use sand dollars (shells) as currency. For simplicity, assume that people consume only one good: fish. Currently, there are 400 sand dollars in circulation and there are 200 fish purchased each year. Based on this information, what is the price of fish? Now, suppose that a change in climate leads to new sand dollars washing ashore, leaving a total of 500 sand dollars. If there are still 200 fish purchased each year, what is the new price of fish? In order to prevent inflation, what would have to happen to the amount of fish purchased each year? When there are 400 sand dollars and 200 fish purchased in a year, this implies that each fish costs 2 sand dollars (= 400/200). When the number of sand dollars increases to 500, the price of fish will increase to 2.5 sand dollars per fish (= 500/200). In order to prevent this inflation in fish prices, the number of fish would have to be increased to 250. That is, if there are 500 sand dollars and 250 fish, the price of fish would go back to 2 sand dollars per fish (= 500/250). |

| AACSB: Analytic Blooms: Apply Cecchetti - Chapter 02 #81 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 82. | What does it mean to say that an asset is "liquid"? An asset is liquid when it can be converted into a means of payment, quickly without suffering a loss in value. |

| AACSB: Reflective Thinking Blooms: Remember Cecchetti - Chapter 02 #82 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #83 Difficulty: 3 Hard Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 84. | Many college campuses use student ID cards as a way for students to pay for on-campus expenses, such as books, photocopies, and food. For convenience, some students will maintain a balance on their ID cards. Are these balances a means of payment? Are they a store of value? Explain why or why not. The balances on the cards serve as both a means of payment and a store of value. Using the student ID card in this way is an example of a stored-value card, similar to a gift card for a store, or a card used to pay for public transportation. While these stored value cards are not included in the money supply, they are used as a means of payment and a store of value. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #84 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 85. | Explain why the following statement is true, "money is an asset but not all assets are money." Money is an asset because it represents something of value to the owner. But not all assets can be used as an immediate means of payment. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #85 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 86. | Explain how money solves the problem of the "double coincidence of wants." In an economy that does not rely on the use of money, if people are going to specialize at all they have to resort to barter, which is the exchange of one good or service for another. In the situation of barter, it may be likely that the individual who has what the other person wants will not want what the other person has. In this case multiple trades may be necessary to ultimately obtain what is desired. With the use of money, since everyone generally accepts it, one exchange will suffice. In reality you can say that money creates an immediate double coincidence of wants. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #86 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 87. | Suppose there is an economy that has 100 people each of whom makes a different good, and that they use a barter system for exchange. How many relative prices will there be? The general formula for the number of prices is n(n - 1)/2; where n = the number of goods. Since we have 100 people each producing one good, we have 100 goods, so n = 100. Plugging this into our formula, we obtain: 100(99)/2 = 4950; so there will be 4,950 relative prices. |

| AACSB: Analytic Blooms: Apply Cecchetti - Chapter 02 #87 Difficulty: 3 Hard Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 88. | Is the characteristic that distinguishes money from other assets its ability to be a store of value? No; there are many assets that fall into the category of financial assets that are good stores of value, these include bonds and stocks. What distinguishes money is that it is liquid, meaning it can immediately serve as a means of payment. This is not true of other assets, which must be converted to spendable form. Moreover, it can be costly to turn a bond or stock into a means of payment, especially if it must be done on short notice. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #88 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 89. | What distinguishes commodity money from fiat money? Commodity money, such as gold or silver, has value even if it is not used as money. For example, gold coins could be melted down and converted to jewelry. Fiat money, such as U.S. paper currency really has no value other than its use as money. Its value derives from the fact that it is deemed to be legal tender by the U.S. government and along with people's willingness to accept it. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #89 Difficulty: 1 Easy Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 90. | During the U.S. Civil War the Confederate government had to resort to printing currency to obtain the goods they needed. Comment on what you think happened to both prices and the value of this currency at the end of the war. While the Confederate government was printing this currency in increasing amounts the prices in the South undoubtedly were rising. Any time currency is made increasingly available the eventual result will be higher prices. In addition, when the war ended and the Confederate states lost, the currency was basically worthless since there was no government that could guarantee its value. It was probably the case that as it was becoming clearer to people living in Confederate states that the outcome of the war was not going to be in their favor, it would not have been surprising if the people relied less on the currency and more on barter. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #90 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 91. | You purchase a good by writing a check for $1,000. Considering the financial payments system this check follows, when is the check money? Explain. The check itself is never money; rather it is the balances on deposit that represent money. Therefore the $1,000 was money when it was in your checking account and that $1,000 will be money again when the Federal Reserve credits the reserve account of the bank receiving the check (and debits your bank's reserve account). |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #91 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 92. | Explain why credit cards are not considered money even though people seem to use them like money. A credit card isn't money for a few reasons. One, it is not an asset. The use of a credit card actually creates a liability for the user. A credit card is a promise by a bank to lend the cardholder money with which to make purchases. The store supplying the goods being purchased receives money, but the money that is used does not belong to the buyer. The credit card provides the cardholder with access to someone else's money. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #92 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 93. | Explain the difference(s) between a debit card and a credit card. A debit card works the same way as a check, in that it provides the bank with instructions to transfer funds from the cardholder's account to the merchant's account. The debit card-holder must have adequate funds in his/her checking account to cover the purchase. A credit card is a promise by a bank to lend the cardholder money with which to make purchases. The store supplying the goods being purchased receives money, but the money that is used does not belong to the buyer, the credit card provides the cardholder with access to someone else's money. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #93 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 94. | Rank the following assets from most liquid to least liquid. a) Common stock b) Houses c) Currency d) Art e) Savings accounts f) Checking account deposits. Ranked from most liquid to least liquid: #1) Currency; #2) Checking account deposits; #3) Savings accounts; #4) Common Stock; #5) Houses; #6) Art. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #94 Difficulty: 1 Easy Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 95. | During what period was money a better store of value: 1960-1980 or 1990-2009? Explain. The period 1990-2009. During the period 1960-1980, inflation often rose to more than 5 percent; during the period 1990-2000, it rarely did. |

| AACSB: Analytic Blooms: Evaluate Cecchetti - Chapter 02 #95 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 96. | The income velocity of money is defined as nominal GDP divided by the money supply. In the first quarter of 2013 the U.S. nominal GDP was estimated to be around $16 trillion annually and M2 was $10460.3 billion. Would the income velocity of M2 be equal to 1; < 1; or > 1? Explain. Greater than one. If you divide nominal GDP of $16 trillion (or $14,500 billion) by $10460.3 billion the result is 1.53. |

| AACSB: Analytic Blooms: Apply Cecchetti - Chapter 02 #96 Difficulty: 3 Hard Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 97. | What is included in M2 that is not included in M1? Small denomination time deposits, plus Savings Deposits and Money Market Deposit Accounts and Retail Money Market Mutual Fund Shares. |

| AACSB: Reflective Thinking Blooms: Remember Cecchetti - Chapter 02 #97 Difficulty: 1 Easy Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 98. | Have the growth rates of the two measures of money moved together over time? Explain. From 1960 to 1980 the growth rates of the two money measures did move together. After 1980 M1 behaved very differently than M2. The main reason for this seems to be the high rates of inflation that began in the late 1970s and fostered innovation into other types of accounts that people could hold to earn a higher return and yet were relatively liquid, such as money market accounts. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #98 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 99. | How useful is M2 in tracking inflation? Explain. Empirical research mentioned in the chapter shows that across many countries, high rates of growth in M2 were associated with high rates of inflation and relatively low growth rates in M2 in many countries also were associated with low rates of inflation. For this reason many economists believe that, at least for moderate inflation rates, controlling inflation means controlling the money growth. |

| AACSB: Analytic Blooms: Create Cecchetti - Chapter 02 #99 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 100. | Has M2 always been a useful tool for forecasting inflation? Explain. From 1960 to 1980 it seemed that growth of M2 was a good tool to forecast inflation, with a two-year lag; in fact the correlation was over 0.5. For the years 1990 to 2013 this does not seem to be the case, in fact the correlation was 0. There is no clear explanation for why the growth of M2 has ceased being a good forecast tool for inflation, but there are some ideas economists are researching. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #100 Difficulty: 2 Medium Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 101. | Why do economists claim the Consumer Price Index (CPI) tends to overstate the actual rate of inflation? The CPI is measured using a fixed-expenditure-weight index. As a result, when the price of a good included in the index increases the assumption is people continue to purchase the same quantity of this item when in reality many consumers (to whatever degree possible) may stop purchasing this item and select a lower priced substitute. This substitution toward a lower-priced good is not reflected in the reported CPI. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #101 Difficulty: 3 Hard Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 102. | How has the Bureau of Labor Statistics (BLS) changed the calculation of the CPI in order to take substitution bias into account? Substitution bias is an overstatement of inflation by the CPI that comes from the fact that the calculation of the index is based on the assumption of an unchanging market basket of goods and services. Since prices do not all rise at the same rate (and some may not rise or may even fall), people can avoid some inflation by changing their spending pattern, that is, substituting lower-priced goods in place of those whose prices have risen. In order to take this into account, the BLS now changes the weights used in the CPI every two years, and today's CPI is a much more accurate measure of inflation than the one published a decade ago. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #102 Difficulty: 3 Hard Learning Objective: 02-03 Understand money links: inflation and economic growth. Topic: Measuring Money |

| 103. | What was the double liquidity shock that occurred in the U.S. financial system in the summer of 2007? Investors began to doubt the value of a wide class of securities so market liquidity for those instruments disappeared and financial institutions that held them faced large losses. In turn, funding liquidity for these institutions dried up as the potential losses caused their lenders to be worried about their safety. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #103 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 104. | Why are electronic transactions increasingly taking the place of paper transactions? Because efficient payments systems continue to evolve and seek easier and cheaper ways to pay for things. |

| AACSB: Reflective Thinking Blooms: Understand Cecchetti - Chapter 02 #104 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 105. | Consider two barter economies: Duos and Varietas. Duos produces two different goods, whereas Varietas produces 80 different goods. Both countries have the same number of people. In which barter economy is it more likely that the means of payment and the units of account would be efficient? How many relative prices are there in Duos compared with Varietas? Which economy would benefit more from adopting money? Payments would be far easier and efficient in Duos. With fewer goods to be traded, the likelihood of reaching a double coincidence of wants would be greater. Also, with fewer goods being produced, the need for specialization is not as great as it would be in Varietas. With 80 different goods, people in Varietas are likely to be specialized. Also, with many different goods, the need for information is much greater in Varietas. Duos would have one relative price, 1 = 2(2 - 1)/2. Varietas would have thousands of relative prices: 3160 = 80(80 - 1)/2. This suggests that quoting prices and recording debts would be easier in Duos. Varietas would benefit more from adopting money, for the reasons cited above. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #105 Difficulty: 2 Medium Learning Objective: 02-01 Understand money and its functions. Topic: Money and How We Use It |

| 106. | After the Revolutionary War, the U.S. monetary system was based on gold. Historically, why did the U.S. adopt the use of gold as a currency? How does this compare with the currency used today? Historically, the U.S. adopted the use of gold as a currency (or as a way to back paper notes) because people had grown suspicious of the use of fiat money. During the Revolutionary War, the Continental Congress issued continentals that became worthless with rising inflation. Using gold to back currency gave the public trust in the government's ability and desire to protect its value (e.g., to prevent rising inflation). Today, the currency printed by the U.S. Treasury Bureau of Engraving and Printing is fiat money. That is, it has little or no intrinsic value. The general public is willing to use this fiat money because it trusts the government's promise to protect its value. People have an expectation that they will be able to use the existing currency to pay for goods and services. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #106 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 107. | Historically, some governments have relied on the revenue generated from printing currency to finance government spending. Give two examples of government's relying on paper currency to finance wartime expenditures. What do you expect happened to inflation rates during these historical episodes? The Continental Congress issued continentals in 1775 to finance the Revolutionary War. The French Revolutionary Government issued assignats in 1793. The inflation rates during both historical episodes increased. The money supply is linked to the economy's inflation rate. As the money supply grows at a faster rate, the inflation rate rises. |

| AACSB: Reflective Thinking Blooms: Remember Cecchetti - Chapter 02 #107 Difficulty: 2 Medium Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 108. | In the chapter you read that it costs the U.S. Treasury's Bureau of Engraving and Printing around nine cents to print a note (currency), whether that bill is a one-dollar or one-hundred dollar bill. It seems the Treasury could generate a nice profit for the government by simply printing currency and using this currency to purchase the goods and services the government needs. In fact, this seems to be a way to eliminate the problem of budget deficits for the U.S. government. Comment on this idea. At first it seems the Treasury could buy one hundred dollars worth of goods for an actual cost of less than six cents, the cost of printing the note. Plus the Treasury can avoid having to borrow to finance the difference between tax receipts and expenditures. But what may be profitable for the Treasury can be very harmful to the economy. The printing of this additional currency can have many serious consequences. The additional currency will increase the money supply, which can fuel higher prices, lowering the real purchasing power of money. If the problem becomes large enough it can actually make people reluctant to accept the currency as a means of payment and they would revert to increased use of barter which can make the economy less efficient. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #108 Difficulty: 3 Hard Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

| 109. | A famous American has been visiting the same tropical island for 15 years for vacations. When she goes she pays for everything by writing checks drawn on her U.S. bank. The currency the natives use are not U.S. dollars; they use a currency called a fungo. The natives never cash her checks. She is so well known on the island that the natives simply trade her checks among themselves. The question you need to answer, complete with an explanation, is: who is paying for her vacation? (You can assume her bank would honor the checks if presented for payment even after a considerable period of time has passed.) Obviously neither the famous American nor her bank is paying for the vacation since the checks are never presented for payment. On the other hand, the famous American is providing the people on the island with additional money, which they seem very comfortable using. As a result, the money supply on the island has increased by the amount of these checks. One result of the added money will be inflation, so islanders will see the real purchasing power of their money decrease, thus their loss in real purchasing power has been used to pay for the famous American's vacations. |

| AACSB: Analytic Blooms: Analyze Cecchetti - Chapter 02 #109 Difficulty: 3 Hard Learning Objective: 02-02 Understand the payments system today and tomorrow. Topic: The Payments System |

ch2 Summary

| Category | # of Questions |

| AACSB: Analytic | 34 |

| AACSB: Reflective Thinking | 75 |

| Accessibility: Keyboard Navigation | 79 |

| Blooms: Analyze | 17 |

| Blooms: Apply | 14 |

| Blooms: Create | 2 |

| Blooms: Evaluate | 2 |

| Blooms: Remember | 34 |

| Blooms: Understand | 40 |

| Cecchetti - Chapter 02 | 109 |

| Difficulty: 1 Easy | 27 |

| Difficulty: 2 Medium | 68 |

| Difficulty: 3 Hard | 14 |

| Learning Objective: 02-01 Understand money and its functions. | 36 |

| Learning Objective: 02-02 Understand the payments system today and tomorrow. | 36 |

| Learning Objective: 02-03 Understand money links: inflation and economic growth. | 37 |

| Topic: Measuring Money | 35 |

| Topic: Money and How We Use It | 38 |

| Topic: The Payments System | 36 |

Chapter 2

Money and the Payments System

Conceptual and Analytical Problems1. Describe at least three ways you could pay for your morning cup of coffee. What are the advantages and disadvantages of each? (LO2)

Answer: You could use money, a check, or a debit card.

Money: This is the most likely to be accepted, but it means you have to replenish your supply periodically.

Check: The least likely to be accepted, and it means you have to walk around with your checkbook. But the funds remain in your bank account for the time it takes the check to make its way through the clearing system.

Debit Card: This is very convenient, and likely to be accepted. But when the electronic signal arrives at your bank later in the day, the funds are withdrawn immediately from your account. (This is probably the cheapest option for the merchant).

2. You are the owner of a small sandwich shop. A buyer may offer one of several payment methods: cash, a check drawn on a bank, a credit card, or a debit card. Which of these is the least costly for you? Explain why the others are more expensive. (LO2)

Answer: Cash is the cheapest option for the merchant; no information is required about the buyer and no additional costs are imposed (though the merchant may need to guard against counterfeiting). Most merchants will ask for a government-issued photo ID in order to accept payment by check, requiring more time per transaction. Even with appropriate identification, the merchant does not know if funds are actually available in the check writer’s account. If not, the merchant will likely undergo a costly process of contacting the buyer and trying to coax the funds from the individual. A payment by credit card provides the merchant with more protection than does a check because the payment is made by the financial institution issuing the card. However, the merchant pays the card issuer a fee (usually a percentage of the transaction value) for the certainty of the payment. Finally, while a debit card electronically transfers funds from the buyer’s account to the merchant’s, this transfer is not instantaneous and the buyer is likely already gone when the merchant may discover that the buyer did not have the funds available.

3. Explain how money encourages specialization, and how specialization improves everyone’s standard of living. (LO3)

Answer: Without money, people have to barter to exchange goods and services. This requires a “double coincidence of wants,” which makes it difficult to specialize. In the example in the text, a plumber is buying groceries; if the grocer doesn’t need a plumbing repair, but does need the outside of his store painted, the plumber may decide to paint the store in order to pay for his groceries even though it is not what he does best. When money is used, people are free to specialize in areas in which they have a comparative advantage, increasing the production of society as a whole, and improving everyone’s standard of living.

4. *Could the dollar still function as the unit of account in a totally cashless society? (LO2)

Answer: Yes. Using dollars and cents to quote prices and record debts does not depend on cash being used as a means of payment. Dollars and cents may still serve as the standard measurement of value even if they are not themselves exchanged.

5. Give four examples of ACH transactions you might make. (LO2)

Answer:

- You receive your paycheck as an electronic transfer from your employer’s account into your account, which may be at a bank different from your employer’s.

- You schedule your monthly electric bill payment to be made automatically.

- You make your payments on your credit card to your bank by scheduling the payment each month for the outstanding balance.

- You make your monthly car payment by arranging for the amount to be deducted from your checking account on the fourth day of each month.

Answer: Each country has the same unit of account, making it easier for a traveler to compare prices in different countries. The traveler also saves the costs of exchanging currencies.

7. Why might each of the following commodities not serve well as money? (LO2)

- Tomatoes

- Bricks

- Cattle

- Tomatoes are perishable and thus would not serve as a store of value.

- Bricks are heavy and bulky and will break easily. In addition, even though bricks break easily, they are not easily divisible into usable units.

- Cattle are not standardized in terms of weight and other potentially important characteristics.

Answer: People will be unwilling to accept $100 bills as payment and will require payment via check, credit card, debit card, or electronic transfer instead, all of which are more costly. Theoretically, inflation could result if the supply of money was increased by a large enough amount.

9. You receive a check drawn on another bank and deposit it into your checking account. Even though this is a “demand deposit” the funds are not immediately available for your use. Why? Would your answer change if the check is drawn on the account of another customer of your own bank? (LO2)

Answer: Funds drawn on another bank are not immediately available (i.e., “on demand”) until the funds are transferred through the check-clearing process. So, when you deposit a check drawn on another bank, you must wait until your bank obtains the funds from the other bank. However, if the check is drawn on an account at your own bank, then the funds are internally transferred from the check writer’s account into your account, so the funds may be available almost immediately.

10. Over a nine-year period in the 16th century, King Henry VIII reduced the silver content of the British pound to one-sixth its initial value. Why do you think he did so? What do you think happened to the use of pounds as a means of payment? If you held both the old and new pounds, which would you use first, and why? (LO1)

Answer: King Henry needed to silver to pay for wars. The use of pounds as a means of payment declined because people could not be sure how much silver each coin contained. People spent the new coins first since the old coins had a higher intrinsic value.

11. Under what circumstances might you expect barter to reemerge in an economy that has fiat money as a means of payment? Can you think of an example of a country where this has happened recently? (LO3)

Answer: You might expect an economy to revert to barter when the public loses confidence in the fiat money issued by the government, perhaps because of over-use of the printing presses. For example, this has happened during episodes of extremely high inflation, such as that experienced in Zimbabwe during much of the 2000’s.

12. You visit a tropical island that has only four goods in its economy – oranges, pineapples, coconuts and bananas. There is no money in this economy. (LO1)

a. Draw a grid showing all the prices for this economy. (You should check your answer using the n(n - 1)/2 formula where n is the number of goods.)

b. An islander suggests designating oranges as the means of payment and unit of account for the economy. How many prices would there be if her suggestion were followed?

c. Do you think the change suggested in part b is worth implementing? Why or why not?

Answer:

a. There would be six prices in total.

| Oranges | Pineapples | Coconuts | Bananas | |

Oranges | ||||

| Pineapples | Pineapples/Oranges | |||

| Coconuts | Coconuts/Oranges | Coconuts/Pineapples | ||

| Bananas | Bananas/Oranges | Bananas/Pineapples | Bananas/Coconuts |

b. There would be three prices – pineapples/oranges, coconuts/oranges and banana/oranges.

c. In the case of this four-good economy, there is only a small gain by using oranges as a unit of account. The gains would be significantly bigger in an economy with more goods. If the islanders think the range of goods in their economy is likely to expand, then it is probably worth implementing the change. One of the drawbacks to consider would be the danger that more people would grow oranges, due to their special status, thus pushing up the prices of the other fruits in terms of oranges.

13. Consider again the tropical island described in Problem 12. Under what circumstances would you recommend the issue of a paper currency by the government of the island? What advantages might this strategy have over the use of oranges as money? (LO1)

Answer: The Islanders must have enough confidence in their government to accept notes backed only by a government decree that have no intrinsic value themselves. The have to believe that these notes will be widely accepted by other islanders as final payment for goods and services and in settlement of debts. They must trust that the government will not print too much of the money and undermine its value.

Some advantages of the paper money over commodity money in the form of oranges include: being easier to carry, longer lasting and more divisible. Most importantly, it would be the government that would control the supply of money on the island as only the government could print new notes, while any of the islanders might decide to grow more oranges.

14. What factors should you take into account when considering using the following assets as stores of value? (LO1)

- Gold

- Real estate

- Stocks

- Government bonds

- The potential for the price of gold to rise, the ability to buy and sell gold easily and any costs associated with storage and security.

- The rate at which real estate is appreciating and is likely to appreciate in the future; how easy or difficult it is to sell real estate; the housing services you could receive from holding the real estate.

- The potential appreciation in nominal value of the stock; the historical volatility of the stock price; the volume of the stock being traded on the secondary market to gauge its liquidity.

- The rate of return on the bonds – including any potential capital gain as well as interest payments.

15. *Under what circumstances might money in the form of currency be the best option as a store of value? (LO3)

Answer: If there were deflation in the economy, then paper currency would increase in value. When deflation occurs, overall prices in the economy are falling and so the currency you hold has more purchasing power. During periods of falling prices of goods and services, prices of assets often fall too and so currency might be an attractive option as a store of value.

16. Suppose a significant fall the price of certain stocks caused the market makers in those stocks to experience difficulties with their funding liquidity. Under what circumstances might that development lead to liquidity problems in markets for other assets? (LO1)

Answer: Faced with difficulties in borrowing money, the market makers in the stocks may decide to hold more cash to ensure their ability to meet clients’ demands. This, in turn, reduces loans available for other market participants potentially causing them to alter their behavior and could lead to funding liquidity problems throughout the financial system. Moreover, to fund itself, the market maker might try to sell other assets, depressing their prices and spreading the disruption.

17. *Consider an economy that only produces and consumes two goods - food and apparel. Suppose the inflation rate based on the consumer price index is higher during the year than that based on the GDP deflator. Assuming underlying tastes and preferences in the economy stay the same, what can you say about food and apparel price movements during the year? (LO3)

Answer: Since the two price indices yield different inflation rates with preferences remaining constant, the relative price of the two goods must have changed. In other words, the price of one of the goods must have gone up by a greater percentage than the other. For example, suppose the price of food went up by 10% while the price of apparel went up by 20%. This would induce consumers to substitute away from apparel to food. As a fixed weight index, the CPI would not take this substitution into account while the GDP deflator would, as it is calculated on the basis of what is actually purchased. Therefore, the CPI inflation rate would be higher than the rate calculated from the GDP deflator.

18. Assuming no interest is paid on checking accounts, what would you expect to see happen to the relative growth rates of M1 and M2 if interest rates rose significantly? (LO3)

Answer: When interest rates rise, you would expect that people would shift funds from checking accounts into savings accounts, as the opportunity cost of holding funds in a non-interest bearing account has risen. Checking accounts are a component of M1 while both checking and some savings accounts are included in M2. Therefore, any shift from checking to savings accounts would depress growth in M1 to a greater degree than growth in M2, leading to a relative increase in the M2 growth rate.

19. If money growth is related to inflation, what would you expect to happen to the inflation rates of countries that join a monetary union and adopt a common currency such as the euro? (LO3)

Answer: Once countries join a monetary union, they effectively share a common money supply. Given the link between money growth and inflation, you would expect the inflation rates of these countries to converge.

Data Exploration

1. Find the most recent level of M2 (FRED code: M2SL) and of the U.S. population (FRED code: POP). Compute the quantity of money divided by the population. Do you think your answer is large? Why? (Hint: At the FRED Web site, http://research.stlouisfed.org/fred2/, type “M2SL” in the search box at the top right and find the most recent observation above the graph. Repeat for “POP.”)

Answer: In March 2013, the value of M2 was $10,447 billion. The total population was 315.8 million, resulting in M2 per capita of $33,081. This seems like a lot, but M2 includes money market mutual fund shares, money market deposit accounts, small-denomination time deposits, checking accounts, and traveler’s checks in addition to currency in the hands of the public. It also includes holdings by businesses, in addition to households.

2. Reproduce Figure 2.3 from 1960 to the present, showing the percent change from a year ago of M1 (FRED code: M1SL) and M2 (FRED code: M2SL). Comment on the pattern over the last five years. Would it matter which of the two monetary aggregates you looked at? (LO3) (Hints: At the FRED Web site, select “Data Tools” and then “Create Your Own Graphs.” In the search box under “Add Data Series,” type in the code for M1 (M1SL). At the “Units” dropdown box, select “Percentage Change from Year Ago” and then the “Redraw Graph” button. To add M2, select “Add Data Series,” and type in “M2SL” in the search box. Change the start date by selecting the first date in the “Observation Date Range” and choosing the year 1960, click “Copy to All Lines”, and then the “Redraw Graph” button.)

Answer: Following the directions given, the data plot of Figure 2.3 is:

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhBpt4ZJgsyRrEFSkKCxqZqH-8HHfCo9ZODNh8XZBlP1uQdBn1wrCttrFbbgojxTkEDupG8Pv62y34J7jot30GAKwIIyTsCmLsHPFjeFVH8EI8ojf7ycT9stj9b66yogK701KwY6YB9RFI//?imgmax=800)

3. Which usually grows faster: M1 or M2? Produce a graph showing M2 divided by M1. When this ratio rises, M2 outpaces M1, and vice versa. What is the long-run pattern? Is the pattern stable? (LO3) (Hints: Follow the initial procedure in Data Exploration question 2, selecting “Data Tools,” then “Create Your Own Graphs,” and then “Add Data Series.” First graph M2 by typing in “M2SL” in the search box. To add M1 and calculate the ratio, select “Add Data Series,” click on the “Line 1” button – so that only one line will be graphed – and type “M1SL” in the search box. Scroll down to the Formula box and type in “a/b” and select “Redraw Graph.”)

Answer: Following the directions given, the plot of the ratio M2/M1 appears below. Over the long run, M2 has usually grown faster than M1, but this pattern is not stable. In particular, M2 growth fell relative to M1 growth after the recession of the early 1990s and after the financial crisis of 2007-09. Later in the book, we will see that both periods were characterized by heightened caution on the part of banks.

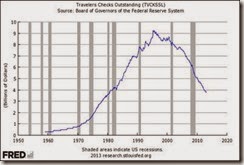

4. Traveler’s checks are a component of M1 and M2. Using FRED, produce a graph of this component of the monetary aggregates (FRED code: TVCKSSL). Explain the pattern you see. (LO1) (Hints: Follow the procedure in Data Exploration question 2 for graphing M1.)

Answer: The indicated data plot is:

The use of traveler’s checks has declined since the mid-1990s. Traveler’s checks were essentially prepaid checks drawn on the account of a widely-recognized issuer. As such, they were convenient for making payments when voyaging away from the geographical area covered by your bank. Merchants in other areas who lacked familiarity with banks outside their own locations might be unwilling to accept your personal check. The rise of nationwide banking and the proliferation of credit and debit cards have reduced the demand for traveler’s checks.

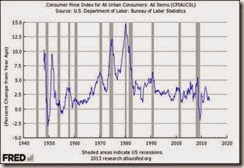

5. Plot the annual inflation rate based on the percent change from a year ago of the consumer price index (FRED code: CPIAUCSL). Comment on the average and variability of inflation in the 1960s, the 1970s, and the most recent decade. (LO3) (Hints: Follow the procedure in Data Exploration question 2 for graphing M1 by typing “CPIAUCSL” in the search box beneath “Add Data Series.” Next, at the “Units” dropdown box select “Percentage Change from Year Ago” and then “Redraw Graph.” Save this graph and name it “CPI Inflation” so that you can update it easily in the future.)

Answer: The indicated data plot is:

The variability of inflation in the 1960s was reasonably low in the first part of the decade, then rising with the trend of inflation toward the end. In the 1970s, inflation was highly variable and averaged well above the the 1960s norm. Over the decade to 2013, inflation was variable mostly during the financial crisis of 2007-2009. In general, periods with low average inflation – such as the first half of the 1960s and the long interval from the mid-1980s to the financial crisis – also were periods of relatively low inflation variability.

* indicates more difficult problems

No comments:

Post a Comment